Brown Capital Management, an investment management company, released its “The Brown Capital Management Small Company Fund” second quarter 2024 investor letter. A copy of the letter can be downloaded here. The Small Company Fund returned -6.57%, underperforming the Russell 2000 Growth index’s 2.92% decline. Fundamental and macroeconomic factors drove the underperformance of the fund in the quarter. The fund aims to identify and invest in Exceptional Growth Companies (EGCs) that focus on products and services their customers cannot live without. In addition, check the fund’s top five holdings to know its best picks in 2024.

Brown Capital Management Small Company Fund highlighted stocks like Glaukos Corporation (NYSE:GKOS) in the second quarter 2024 investor letter. Glaukos Corporation (NYSE:GKOS) is an ophthalmic pharmaceutical and medical technology company. The one-month return of Glaukos Corporation (NYSE:GKOS) was 6.42%, and its shares gained 70.17% of their value over the last 52 weeks. On September 6, 2024, Glaukos Corporation (NYSE:GKOS) stock closed at $129.28 per share with a market capitalization of $7.104 billion.

Brown Capital Management Small Company Fund stated the following regarding Glaukos Corporation (NYSE:GKOS) in its Q2 2024 investor letter:

“Glaukos Corporation (NYSE:GKOS) is a medical-device company that specializes in the treatment of glaucoma. The company offers a suite of products such as iStent, Infinite, iDose and others. iStent is a permanent stent designed to treat glaucoma by opening the drainage canal and lowering intraocular pressure. The most recent iStent product, Infinite, allows multiple stents to be used to treat glaucoma as a standalone procedure. iDose is a tiny implant that allows for the continuous delivery of drugs to treat glaucoma. iDose was approved by the FDA in December 2023 and has proven to be a true paradigm shift in glaucoma treatment.

Glaukos reported strong first quarter results with 16% revenue growth. Importantly, the U.S. market drove the upside. The core iStent-Infinite product beat expectations and is taking market-share. In addition, iDose began shipping in the quarter. It is receiving a strong reception in the market and we expect it to become a significant contributor over the next few years, adding to the potential of Glaukos’s broad pipeline. Glaukos is developing iDose TRIO which surgeons can implant in the office vs. at a surgery center. This is targeted for a late 2025 introduction. Also in the pipeline is iDose TREX, targeted for commercialization in late 2027 or early 2028. iDose TREX can potentially hold twice as much medication and extend the duration of effect. We see strong long-term revenue growth for Glaukos.”

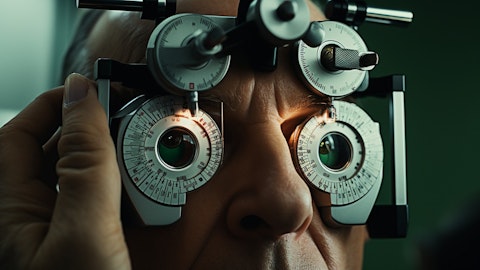

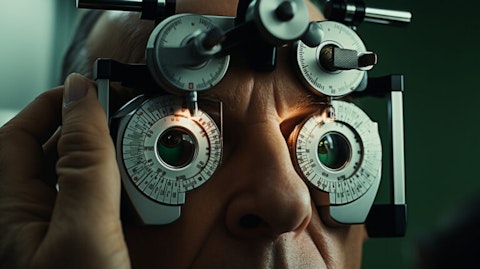

A doctor examining a patient’s eyes with an ophthalmic medical device.

Glaukos Corporation (NYSE:GKOS) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 26 hedge fund portfolios held Glaukos Corporation (NYSE:GKOS) at the end of the first quarter which was 27 in the previous quarter. In the second quarter, Glaukos Corporation (NYSE:GKOS) reported net sales of $95.7 million, up 19% on a reported basis and 20% on a constant currency basis compared to Q2 2023. The outstanding performance led the company to increase its full-year 2024 net sales guidance range. While we acknowledge the potential of Glaukos Corporation (NYSE:GKOS) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Glaukos Corporation (NYSE:GKOS) and shared Alger Weatherbie Specialized Growth Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.