ClearBridge Investments, an investment management company, released its “ClearBridge Value Equity Strategy” first quarter 2024 investor letter. A copy of the letter can be downloaded here. The strategy outperformed the Russell 1000 Value Index in the first quarter. On an absolute basis, the strategy has gained 9 out of eleven sectors it invested in during the quarter. Financial and utilities sectors were the leading contributors while the real estate and healthcare sectors detracted. Overall stock selection and sector allocation contributed to returns relatively. In addition, please check the fund’s top five holdings to know its best picks in 2024.

ClearBridge Value Equity Strategy highlighted stocks like American International Group, Inc. (NYSE:AIG) in the first quarter 2024 investor letter. American International Group, Inc. (NYSE:AIG) is an insurance products provider for commercial, institutional, and individual customers. American International Group, Inc.’s (NYSE:AIG) one-month return was -1.72%, and its shares gained 30.01% of their value over the last 52 weeks. On July 2, 2024, American International Group, Inc. (NYSE:AIG) stock closed at $75.33 per share with a market capitalization of $49.994 billion.

ClearBridge Value Equity Strategy stated the following regarding American International Group, Inc. (NYSE:AIG) in its first quarter 2024 investor letter:

“One example of our internal return engine is our continued large position in American International Group, Inc. (NYSE:AIG), which we have owned for roughly 10 years. We originally bought AIG at a greater than 30% discount to our initial estimate of business value. This entry point assumed minimal improvements in the business but allowed us to absorb some inevitable downdrafts along the way that we took advantage of to build our position. The key, however, is that during this period AIG management dramatically improved their business. The company has compounded intrinsic business value per share at a double-digit rate by reducing risks as management overhauled their underwriting process, strengthened their balance sheet, cut expenses and operational complexity and structurally improved returns on equity. A major source of added lift came from intelligent capital allocation: shares outstanding have been more than cut in half during this period, as management bought back roughly 5% of the company annually below intrinsic business value.

However, this valuation-driven return engine can only create so much lift on its own. We are always looking for big opportunities to create external lift in our returns from dramatic shifts in markets. The first comes from exploiting market extremes, where the long-term probabilities are very much in our favor, while the second comes from investor underreactions to big shifts in pricing power that can be exploited through our valuation-driven lens.”

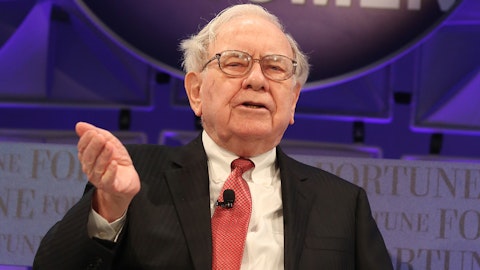

A professional advisor helping a client with an insurance policy, highlighting the company’s attention to customer service.

American International Group, Inc. (NYSE:AIG) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 54 hedge fund portfolios held American International Group, Inc. (NYSE:AIG) at the end of the first quarter which was 51 in the previous quarter. American International Group, Inc. (NYSE:AIG) reported adjusted after-tax income of $1.2 billion for the quarter, or $1.77 per diluted common share, a 9% increase in earnings per share compared to Q1 2023. While we acknowledge the potential of American International Group, Inc. (NYSE:AIG) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

We discussed American International Group, Inc. (NYSE:AIG) in another article and shared the list of most profitable insurance companies in the world. American International Group, Inc. (NYSE:AIG) was among the leading contributors to Diamond Hill Large Cap Strategy in Q1 2024. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.