ClearBridge Investments, an investment management company, released its “ClearBridge All Cap Growth Strategy” third quarter 2024 investor letter. A copy of the letter can be downloaded here. In the third quarter, the U.S. equities market experienced a brief decline due to disappointing employment statistics, causing an increase in volatility. Stocks surged after the Federal Reserve dropped interest rates by 50 basis points, resulting in wide gains for the period. The strategy performed in line with the benchmark in a value-driven market, with increased participation from positions in health care and communication services. In addition, please check the fund’s top five holdings to know its best picks in 2024.

ClearBridge All Cap Growth Strategy highlighted stocks like Wolfspeed, Inc. (NYSE:WOLF), in the third quarter 2024 investor letter. Wolfspeed, Inc. (NYSE:WOLF) is a bandgap semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies. The one-month return of Wolfspeed, Inc. (NYSE:WOLF) was 20.45%, and its shares lost 73.21% of their value over the last 52 weeks. On December 9, 2024, Wolfspeed, Inc. (NYSE:WOLF) stock closed at $10.07 per share with a market capitalization of $1.286 billion.

ClearBridge All Cap Growth Strategy stated the following regarding Wolfspeed, Inc. (NYSE:WOLF) in its Q3 2024 investor letter:

“We also exited long-time holding Wolfspeed, Inc. (NYSE:WOLF), a leading global supplier of silicon carbide substrate wafers and devices. After giving management ample time to ramp production at its new Mohawk Valley facility, we closed the position due to continued execution missteps and cyclical headwinds impacting electric vehicle, industrial and energy applications that have repeatedly pushed the company’s path to profitability further out.”

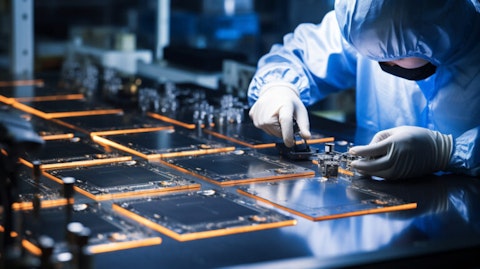

A worker assembling metal oxide semiconductor field effect transistors (MOSFETs) on a conveyer belt.

Wolfspeed, Inc. (NYSE:WOLF) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 26 hedge fund portfolios held Wolfspeed, Inc. (NYSE:WOLF) at the end of the third quarter which was 29 in the previous quarter. For the September quarter, Wolfspeed, Inc. (NYSE:WOLF) reported $195 million in revenue, which was slightly below the midpoint of guidance and down 3% sequentially. While we acknowledge the potential of Wolfspeed, Inc. (NYSE:WOLF) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Wolfspeed, Inc. (NYSE:WOLF) and shared the list of best tech stocks to invest in on the dip. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.