On Aug. 16, Capital One Financial Corp. (NYSE:COF) announced it would acquire Beech Street Capital, a private originator and servicer of multifamily commercial real estate loans. With a successful history of acquisitions behind it, investors need to know if Capital One is poised to add to that count, or if this is another example of a bank overextending itself into a business it shouldn’t be in.

Beech Street makes loans for apartment buildings, condominiums, and other properties, then typically sells those debts through three large government housing agencies: Fannie Mae, Freddie Mac, and the Federal Housing Administration. Last year, Beech Street originated $4 billion in multifamily loans.

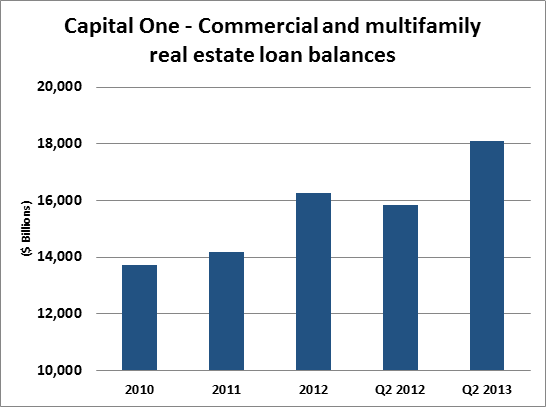

Capital One Financial Corp. (NYSE:COF) has steadily seen its commercial multifamily real estate loans rise over the last five quarters as it has shifted its business away from its reliance on credit cards, to consumer and commercial lending, to mimic that of the more traditional banking powers.

Source: Company filings.

Beech Street also has seen significant growth in its loan portfolio. It issued $1 billion in loans in 2009, its inaugural year, which grew to the aforementioned $4 billion in 2012. This growth corresponded with the booming expansion of the amount of multifamily properties constructed:

Source: NAHB

In addition, Freddie Mac recently released its Multifamily Mid-Year Outlook, which reinforced the same growth prospects. Multifamily loan volume plummeted from roughly $148 billion in 2007, to $52 billion in 2009. But the market has seen substantial advancement since then, rising to $143 billion last year.

That growth has continued, with the Census Bureau reporting that 114,000 complexes with 20 or more bedrooms have begun construction in the first two quarters of this year. That compares with just 76,000 over the first two quarters of last year, representing 50% growth. In fact, the recently released Multifamily Investment Index provided by Freddie Mac, which categorizes the investment attractiveness of the multifamily market, is at its highest level since 2008.

In all of this, we see that Capital One Financial Corp. (NYSE:COF) made this acquisition with the clear purpose of further entrenching itself into a rapidly growing and attractive industry. It’s difficult to determine exactly what it means to investors because the terms of the deal were not disclosed, and Beech Street was a private company.

If we look for a comparable across Beech Street’s competitive landscape, we find another Bethesda, Md.-based multifamily commercial real estate lender, Walker & Dunlop, Inc. (NYSE:WD).

Walker and Dunlop originated roughly $7 billion in loans in 2012, compared to Beech Street’s $4 billion, and has a servicing portfolio of almost $38 billion, according to its most recent results. Walker & Dunlop, Inc. (NYSE:WD) carries a market value of just over $500 million — but is down almost 13% in 2013 after lackluster second-quarter earnings.

However, investors should rest assured with the knowledge that Capital One Financial Corp. (NYSE:COF) has a successful history of acquisitions, from ING Direct, to the HSBC credit card portfolio. Depending on the terms of the deal, this could be another one.

The article Here’s Why Capital One Financial Corp (NYSE:COF). Bought This Company originally appeared on Fool.com.

Patrick Morris has no position in any stocks mentioned. The Motley Fool owns shares of Walker & Dunlop.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.