ClearBridge Investments, an investment management company, released its “ClearBridge Small Cap Growth Strategy” fourth quarter 2024 investor letter. A copy of the letter can be downloaded here. A partial change in leadership in the second half of 2024 may continue into 2025 as a number of macro factors stabilize and small-cap earnings growth is expected to surpass that of its up-market counterparts. In the fourth quarter, the strategy performed in line with the benchmark, the Russell 2000 Growth Index. The strength in industrials and health care was offset by weakness in IT and consumer discretionary sectors. In addition, please check the fund’s top five holdings to know its best picks in 2024.

ClearBridge Small Cap Growth Strategy highlighted stocks like Bloom Energy Corporation (NYSE:BE), in the fourth quarter 2024 investor letter. Bloom Energy Corporation (NYSE:BE) engages in the design manufacture and installation of solid-oxide fuel cell systems for on-site power generation. The one-month return of Bloom Energy Corporation (NYSE:BE) was -1.73%, and its shares gained 87.97% of their value over the last 52 weeks. On January 8, 2025, Bloom Energy Corporation (NYSE:BE) stock closed at $24.38 per share with a market capitalization of $5.573 billion.

ClearBridge Small Cap Growth Strategy stated the following regarding Bloom Energy Corporation (NYSE:BE) in its Q4 2024 investor letter:

“Additionally, outperformance across a diverse range of our industrial holdings was a positive contributor. One standout was Bloom Energy Corporation (NYSE:BE), a provider of alternative energy products, which announced a significant partnership with a major utility to provide fuel cells to power AI data centers, crystalizing its potential exposure to an fast-growing source of power demand.”

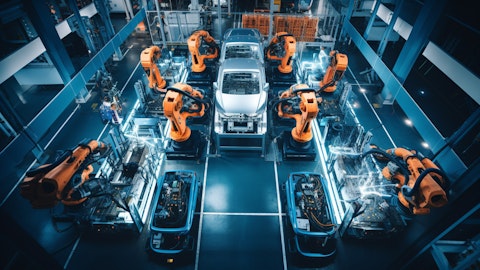

A bird’s eye view of a power generation platform with a power plant in the background.

Bloom Energy Corporation (NYSE:BE) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 25 hedge fund portfolios held Bloom Energy Corporation (NYSE:BE) at the end of the third quarter which was 29 in the previous quarter. Bloom Energy Corporation (NYSE:BE) reported $330.4 million in revenues in the third quarter, a decrease of 17.5% compared to Q3 2023. While we acknowledge the potential of Bloom Energy Corporation (NYSE:BE) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Bloom Energy Corporation (NYSE:BE) and shared the list of AI stocks that skyrocketed in Q4 2024 along with experts’ opinions on the future of AI. In addition, please check out our hedge fund investor letters Q4 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.