Madison Investments, an investment advisor, released its “Madison Investors Fund” second-quarter 2024 investor letter. A copy of the letter can be downloaded here. In the second quarter, the fund (Class Y) fell by 1.03% compared to a 4.28% return for the S&P 500 index. YTD the fund returned 8.50% compared to a 15.29% return for the index. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Madison Investors Fund highlighted stocks like Analog Devices, Inc. (NASDAQ:ADI) in the second quarter 2024 investor letter. Analog Devices, Inc. (NASDAQ:ADI) designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products. The one-month return of Analog Devices, Inc. (NASDAQ:ADI) was 4.13%, and its shares gained 26.02% of their value over the last 52 weeks. On July 18, 2024, Analog Devices, Inc. (NASDAQ:ADI) stock closed at $238.99 per share with a market capitalization of $118.591 billion.

Madison Investors Fund stated the following regarding Analog Devices, Inc. (NASDAQ:ADI) in its Q2 2024 investor letter:

“At semiconductor manufacturers Analog Devices, Inc. (NASDAQ:ADI) and Texas Instruments, sales and profits continue to decline due to weak demand, as well as customers and distributors reducing inventory after building it up during the supply chain induced shortages a few years back. However, the shares of both companies appreciated nicely during the quarter as the cycle appears to be bottoming, and investors better appreciate the industry’s secular demand characteristics. We believe this sets the conditions for a nice rebound in profits for these companies over the coming years.”

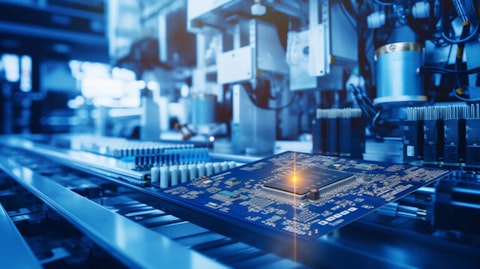

A technician working on power management in a semiconductor factory.

Analog Devices, Inc. (NASDAQ:ADI) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 65 hedge fund portfolios held Analog Devices, Inc. (NASDAQ:ADI) at the end of the first quarter which was 62 in the previous quarter. Analog Devices, Inc. (NASDAQ:ADI) reported second-quarter revenue of $2.16 billion, down 34% year-over-year. While we acknowledge the potential of Analog Devices, Inc. (NASDAQ:ADI) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Analog Devices, Inc. (NASDAQ:ADI) and shared the list of buzzing AI semiconductor stocks in 2024. Madison Investors Fund expressed its positive outlook for Analog Devices, Inc. (NASDAQ:ADI) in the previous quarter. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.