Baron Funds, an investment management company, released its “Baron Technology Fund” second quarter 2024 investor letter. A copy of the letter can be downloaded here. After a slow start to the quarter, U.S. stocks increased steadily in May and June. In the second quarter, the fund rose 7.09% (Institutional Shares) underperforming an 11.38% return for the MSCI ACWI Information Technology Index (the Benchmark) and outperforming the 4.28% gain for the S&P 500 index. For the first half of 2024, the fund delivered solid returns, increasing 22.86% compared to 24.80% and 15.29% returns for the indexes. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Baron Technology Fund highlighted stocks like Advanced Micro Devices, Inc. (NASDAQ:AMD) in the second quarter 2024 investor letter. Advanced Micro Devices, Inc. (NASDAQ:AMD) is a semiconductor company that operates through Data Center, Client, Gaming, and Embedded segments. The one-month return of Advanced Micro Devices, Inc. (NASDAQ:AMD) was 3.85%, and its shares gained 31.44% of their value over the last 52 weeks. On September 3, 2024, Advanced Micro Devices, Inc. (NASDAQ:AMD) stock closed at $139.44 per share with a market capitalization of $225.681 billion.

Baron Technology Fund stated the following regarding Advanced Micro Devices, Inc. (NASDAQ:AMD) in its Q2 2024 investor letter:

“Advanced Micro Devices, Inc. (NASDAQ:AMD) is a global fabless semiconductor company focusing on high performance computing technology, software, and products including CPUs,9 GPUs, FPGAs,10 and others. Shares of AMD remain volatile, and after a strong run earlier in the year, the stock fell during the quarter as investors continue to wrestle with AMD’s competitive positioning in the AI compute market relative to NVIDIA, who continues to strengthen its full-system solution offerings at a rapid pace. AMD also updated its MI300 GPU chip revenue expectations for the full year to “greater than $4 billion” vs. prior $3.5 billion, which disappointed the market a bit relative to high expectations. Over the long-term, we believe AMD, with its unique chiplet-based architecture and open-source software ecosystem, will play a meaningful role in the rapidly growing AI compute market, where customers don’t want to be locked into a single vendor and AMD offers a compelling total-cost-of-ownership proposition, especially in inferencing workloads. Simultaneously, we believe AMD will continue to take share from Intel within traditional data center CPUs, which, while now a slower growth market, is likely to see a near-term refresh as data centers look for ways to improve energy efficiency and optimize existing footprints.”

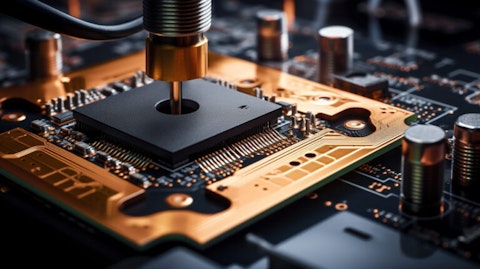

A close-up view of an electronic component being installed on a PCB.

Advanced Micro Devices, Inc. (NASDAQ:AMD) is in 13th position on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 108 hedge fund portfolios held Advanced Micro Devices, Inc. (NASDAQ:AMD) at the end of the second quarter which was 124 in the previous quarter. While we acknowledge the potential of Advanced Micro Devices, Inc. (NASDAQ:AMD) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Advanced Micro Devices, Inc. (NASDAQ:AMD) and shared the list of best AI stocks to buy according to Reddit. Advanced Micro Devices, Inc. (NASDAQ:AMD) detracted from the performance of Alger Spectra Fund during Q2 2024. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.