We can judge whether Textron Inc. (NYSE:TXT) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

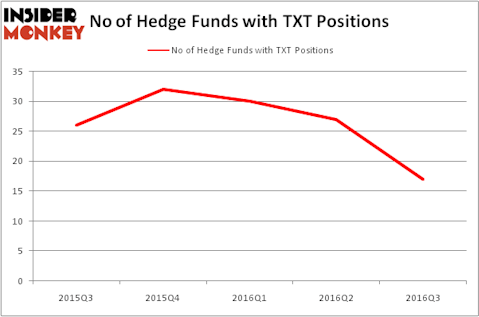

So, is Textron Inc. (NYSE:TXT) a bargain? It looks like prominent investors are getting less bullish. The number of long hedge fund positions dropped by 10 during the third quarter. In this way, there were 17 funds tracked by Insider Monkey holding shares of Textron at the end of September. At the end of this article we will also compare TXT to other stocks including Akamai Technologies, Inc. (NASDAQ:AKAM), WestRock Co (NYSE:WRK), and Mettler-Toledo International Inc. (NYSE:MTD) to get a better sense of its popularity.

Follow Textron Inc (NYSE:TXT)

Follow Textron Inc (NYSE:TXT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

travellight/Shutterstock.com

Keeping this in mind, we’re going to go over the key action regarding Textron Inc. (NYSE:TXT).

How are hedge funds trading Textron Inc. (NYSE:TXT)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in Textron, down by 37% from the end of June. The graph below displays the number of hedge funds with bullish position in TXT over the last five quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’ AQR Capital Management holds the most valuable position in Textron Inc. (NYSE:TXT). According to regulatory filings, the fund has a $96.6 million position in the stock. Sitting at the No. 2 spot is Mario Gabelli’s GAMCO Investors, with an $86.2 million position. Some other hedge funds and institutional investors with similar optimism encompass Anand Parekh’s Alyeska Investment Group, Ken Griffin’s Citadel Investment Group and Christopher A. Winham’s Tide Point Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually dropped their positions entirely. Intriguingly, Israel Englander’s Millennium Management dropped the largest stake of the 700 funds tracked by Insider Monkey, comprising an estimated $16.2 million in stock, and Jim Simons’ Renaissance Technologies was right behind this move, as the fund dumped about $7.2 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to Textron Inc. (NYSE:TXT). We will take a look at Akamai Technologies, Inc. (NASDAQ:AKAM), WestRock Co (NYSE:WRK), Mettler-Toledo International Inc. (NYSE:MTD), and Total System Services, Inc. (NYSE:TSS). This group of stocks’ market caps are closest to TXT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AKAM | 36 | 707311 | 6 |

| WRK | 29 | 752003 | 4 |

| MTD | 21 | 484521 | 1 |

| TSS | 32 | 430356 | 0 |

As you can see these stocks had an average of 30 funds with bullish positions and the average amount invested in these stocks was $594 million, which is higher than the $388 million figure in TXT’s case. Akamai Technologies, Inc. (NASDAQ:AKAM) is the most popular stock in this table. On the other hand Mettler-Toledo International Inc. (NYSE:MTD) is the least popular one with only 21 funds holding shares. Compared to these stocks Textron Inc. (NYSE:TXT) is even less popular than Mettler-Toledo International Inc. (NYSE:MTD). Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None