Investment advisory firm Ithaka Group released the “Ithaka US Growth Strategy” third-quarter 2024 investor letter. A copy of the letter can be downloaded here. The market continued to rise, which began in late October 2023, and gained across multiple asset classes. However, the portfolio underperformed in this up-market, increasing 0.4% (gross of fees) compared to the R1000G, which increased by 3.2%. Stock selection drove the portfolio to underperform in the quarter, with a negligible tailwind from sector allocation. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Ithaka US Growth Strategy highlighted stocks like ASML Holding N.V. (NASDAQ:ASML) in the third quarter 2024 investor letter. ASML Holding N.V. (NASDAQ:ASML) is an advanced semiconductor equipment systems manufacturer for chipmakers. The one-month return of ASML Holding N.V. (NASDAQ:ASML) was -18.60%, and its shares gained 7.32% of their value over the last 52 weeks. On October 30, 2024, ASML Holding N.V. (NASDAQ:ASML) stock closed at $683.83 per share with a market capitalization of $276.209 billion.

Ithaka US Growth Strategy stated the following regarding ASML Holding N.V. (NASDAQ:ASML) in its Q3 2024 investor letter:

“ASML Holding N.V. (NASDAQ:ASML) is a leading supplier of photolithography equipment used in semiconductor manufacturing, enabling the production of microchips at ever-smaller line widths. The company’s cutting-edge technologies, particularly extreme ultraviolet (EUV) lithography, play a critical role in producing the most advanced chips for applications like smartphones, data centers, and AI. ASML’s systems are vital for the semiconductor industry, helping to push the boundaries of Moore’s Law and drive innovation in electronics. Like most players in the global semiconductor space, ASML suffered from various government restrictions placed on sales of systems to countries considered adversarial to US interests. In particular, during the quarter ASML’s strong earnings report was overshadowed by the Biden administration telling its allies the US was considering imposing severe trade restrictions to limit ASML from selling/servicing lithography systems in China.”

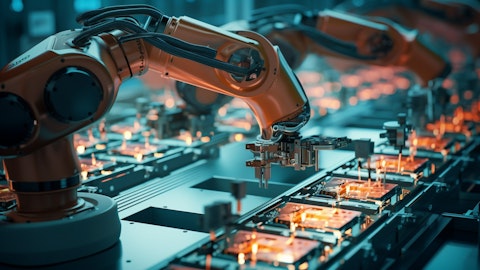

A technician in a clean room working on a semiconductor device, illuminated by the machines.

ASML Holding N.V. (NASDAQ:ASML) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 81 hedge fund portfolios held ASML Holding N.V. (NASDAQ:ASML) at the end of the second quarter which was 75 in the previous quarter. While we acknowledge the potential of ASML Holding N.V. (NASDAQ:ASML) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed ASML Holding N.V. (NASDAQ:ASML) and shared the list of stocks set to explode in 2025. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.