We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of LPL Financial Holdings Inc (NASDAQ:LPLA) based on that data.

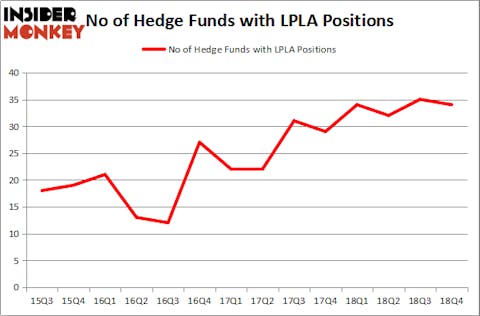

LPL Financial Holdings Inc (NASDAQ:LPLA) was in 34 hedge funds’ portfolios at the end of the fourth quarter of 2018. LPLA investors should be aware of a decrease in enthusiasm from smart money of late. There were 35 hedge funds in our database with LPLA positions at the end of the previous quarter. Our calculations also showed that LPLA isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are dozens of metrics market participants use to value their holdings. A duo of the most under-the-radar metrics are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a healthy amount (see the details here).

We’re going to take a look at the recent hedge fund action surrounding LPL Financial Holdings Inc (NASDAQ:LPLA).

What have hedge funds been doing with LPL Financial Holdings Inc (NASDAQ:LPLA)?

At Q4’s end, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in LPLA over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, First Pacific Advisors LLC was the largest shareholder of LPL Financial Holdings Inc (NASDAQ:LPLA), with a stake worth $210.3 million reported as of the end of September. Trailing First Pacific Advisors LLC was Southpoint Capital Advisors, which amassed a stake valued at $174.1 million. Samlyn Capital, Balyasny Asset Management, and Azora Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Since LPL Financial Holdings Inc (NASDAQ:LPLA) has experienced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of money managers who sold off their full holdings by the end of the third quarter. Intriguingly, Jason Karp’s Tourbillon Capital Partners dropped the biggest stake of the “upper crust” of funds followed by Insider Monkey, comprising about $47.8 million in stock, and Philip Hilal’s Clearfield Capital was right behind this move, as the fund dropped about $22.3 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to LPL Financial Holdings Inc (NASDAQ:LPLA). We will take a look at Dunkin Brands Group Inc (NASDAQ:DNKN), Euronet Worldwide, Inc. (NASDAQ:EEFT), YPF Sociedad Anonima (NYSE:YPF), and Perrigo Company plc (NASDAQ:PRGO). This group of stocks’ market values resemble LPLA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DNKN | 18 | 108533 | 6 |

| EEFT | 31 | 214658 | 7 |

| YPF | 15 | 213817 | -2 |

| PRGO | 23 | 556413 | 2 |

| Average | 21.75 | 273355 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $273 million. That figure was $1007 million in LPLA’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand YPF Sociedad Anonima (NYSE:YPF) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks LPL Financial Holdings Inc (NASDAQ:LPLA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on LPLA, though not to the same extent, as the stock returned 18.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.