We can judge whether Zendesk Inc (NYSE:ZEN) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

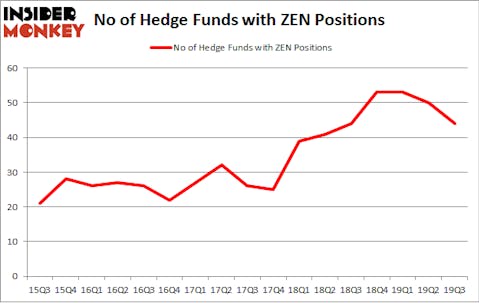

Is Zendesk Inc (NYSE:ZEN) a first-rate investment today? The smart money is selling. The number of bullish hedge fund positions retreated by 6 recently. Our calculations also showed that ZEN isn’t among the 30 most popular stocks among hedge funds. ZEN was in 44 hedge funds’ portfolios at the end of the third quarter of 2019. There were 50 hedge funds in our database with ZEN positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Chase Coleman of Tiger Global

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the key hedge fund action regarding Zendesk Inc (NYSE:ZEN).

How have hedgies been trading Zendesk Inc (NYSE:ZEN)?

Heading into the fourth quarter of 2019, a total of 44 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from one quarter earlier. On the other hand, there were a total of 44 hedge funds with a bullish position in ZEN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Chase Coleman’s Tiger Global Management has the most valuable position in Zendesk Inc (NYSE:ZEN), worth close to $214.8 million, corresponding to 1.1% of its total 13F portfolio. Sitting at the No. 2 spot is Alex Sacerdote of Whale Rock Capital Management, with a $196.3 million position; 3.6% of its 13F portfolio is allocated to the company. Some other peers that are bullish contain Panayotis Takis Sparaggis’s Alkeon Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Greg Poole’s Echo Street Capital Management. In terms of the portfolio weights assigned to each position Half Sky Capital allocated the biggest weight to Zendesk Inc (NYSE:ZEN), around 12.13% of its portfolio. Atalan Capital is also relatively very bullish on the stock, earmarking 6.33 percent of its 13F equity portfolio to ZEN.

Because Zendesk Inc (NYSE:ZEN) has faced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of hedgies that decided to sell off their entire stakes by the end of the third quarter. Intriguingly, Josh Resnick’s Jericho Capital Asset Management dropped the largest investment of all the hedgies watched by Insider Monkey, totaling an estimated $71 million in stock. Brandon Haley’s fund, Holocene Advisors, also dropped its stock, about $39.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 6 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Zendesk Inc (NYSE:ZEN). We will take a look at Royal Gold, Inc (NASDAQ:RGLD), Sensata Technologies Holding plc (NYSE:ST), ABIOMED, Inc. (NASDAQ:ABMD), and Pool Corporation (NASDAQ:POOL). This group of stocks’ market values resemble ZEN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RGLD | 25 | 126740 | 6 |

| ST | 20 | 1377652 | -1 |

| ABMD | 21 | 580988 | -7 |

| POOL | 26 | 402099 | 4 |

| Average | 23 | 621870 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $622 million. That figure was $1454 million in ZEN’s case. Pool Corporation (NASDAQ:POOL) is the most popular stock in this table. On the other hand Sensata Technologies Holding plc (NYSE:ST) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Zendesk Inc (NYSE:ZEN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on ZEN as the stock returned 8.3% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.