At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Is World Acceptance Corp. (NASDAQ:WRLD) a sound investment right now? Hedge funds are getting more bullish. The number of long hedge fund positions rose by 6 lately. Our calculations also showed that WRLD isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to review the fresh hedge fund action regarding World Acceptance Corp. (NASDAQ:WRLD).

Hedge fund activity in World Acceptance Corp. (NASDAQ:WRLD)

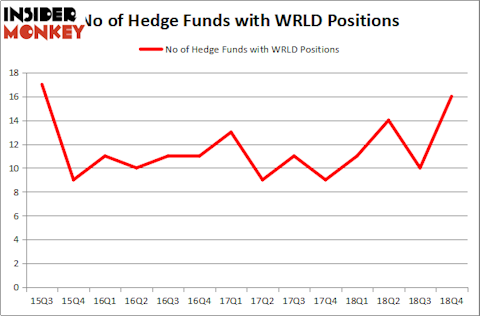

Heading into the first quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards WRLD over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management has the biggest position in World Acceptance Corp. (NASDAQ:WRLD), worth close to $75.9 million, amounting to 2.3% of its total 13F portfolio. Sitting at the No. 2 spot is Clifford A. Sosin of CAS Investment Partners, with a $65.8 million position; the fund has 25% of its 13F portfolio invested in the stock. Some other peers that are bullish contain Jim Simons’s Renaissance Technologies, Andrew Bellas’s General Equity Partners and C. Jonathan Gattman’s Cloverdale Capital Management.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. General Equity Partners, managed by Andrew Bellas, assembled the biggest position in World Acceptance Corp. (NASDAQ:WRLD). General Equity Partners had $17.9 million invested in the company at the end of the quarter. Edward Goodnow’s Goodnow Investment Group also initiated a $6.2 million position during the quarter. The other funds with brand new WRLD positions are James Thomas Berylson’s Berylson Capital Partners, Ronald Hua’s Qtron Investments, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as World Acceptance Corp. (NASDAQ:WRLD) but similarly valued. We will take a look at TTM Technologies, Inc. (NASDAQ:TTMI), KEMET Corporation (NYSE:KEM), Camping World Holdings, Inc. (NYSE:CWH), and Diplomat Pharmacy Inc (NYSE:DPLO). This group of stocks’ market valuations are closest to WRLD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTMI | 15 | 35723 | -1 |

| KEM | 21 | 159175 | 1 |

| CWH | 11 | 71232 | -6 |

| DPLO | 10 | 62300 | -3 |

| Average | 14.25 | 82108 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $217 million in WRLD’s case. KEMET Corporation (NYSE:KEM) is the most popular stock in this table. On the other hand Diplomat Pharmacy Inc (NYSE:DPLO) is the least popular one with only 10 bullish hedge fund positions. World Acceptance Corp. (NASDAQ:WRLD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on WRLD, though not to the same extent, as the stock returned 23% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.