We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Wayfair Inc (NYSE:W) based on that data.

Wayfair Inc (NYSE:W) investors should be aware of an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that w isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action encompassing Wayfair Inc (NYSE:W).

How are hedge funds trading Wayfair Inc (NYSE:W)?

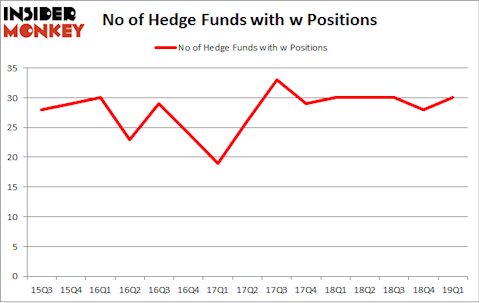

At Q1’s end, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in W over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Spruce House Investment Management held the most valuable stake in Wayfair Inc (NYSE:W), which was worth $556.7 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $462.5 million worth of shares. Moreover, D E Shaw, Bares Capital Management, and Whale Rock Capital Management were also bullish on Wayfair Inc (NYSE:W), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds were breaking ground themselves. Bares Capital Management, managed by Brian Bares, assembled the most valuable position in Wayfair Inc (NYSE:W). Bares Capital Management had $236.5 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $55.3 million investment in the stock during the quarter. The other funds with brand new W positions are David Costen Haley’s HBK Investments, Sander Gerber’s Hudson Bay Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Wayfair Inc (NYSE:W) but similarly valued. These stocks are WellCare Health Plans, Inc. (NYSE:WCG), Conagra Brands, Inc. (NYSE:CAG), Live Nation Entertainment, Inc. (NYSE:LYV), and Seagate Technology plc (NASDAQ:STX). This group of stocks’ market values match W’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WCG | 47 | 1898984 | 8 |

| CAG | 33 | 811917 | 0 |

| LYV | 39 | 1020951 | 2 |

| STX | 24 | 2033293 | -2 |

| Average | 35.75 | 1441286 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $1441 million. That figure was $2455 million in W’s case. WellCare Health Plans, Inc. (NYSE:WCG) is the most popular stock in this table. On the other hand Seagate Technology plc (NASDAQ:STX) is the least popular one with only 24 bullish hedge fund positions. Wayfair Inc (NYSE:W) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately W wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); W investors were disappointed as the stock returned -2.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.