Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Walker & Dunlop Inc. (NYSE:WD) from the perspective of those elite funds.

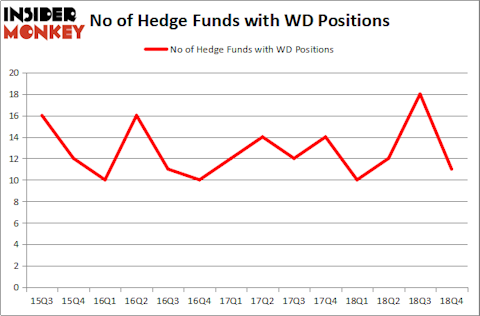

Is Walker & Dunlop Inc. (NYSE:WD) a buy here? The best stock pickers are turning less bullish. The number of long hedge fund positions decreased by 7 recently. Our calculations also showed that WD isn’t among the 30 most popular stocks among hedge funds. WD was in 11 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 18 hedge funds in our database with WD holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the latest hedge fund action encompassing Walker & Dunlop Inc. (NYSE:WD).

What does the smart money think about Walker & Dunlop Inc. (NYSE:WD)?

At the end of the fourth quarter, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -39% from the second quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in WD a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Alyeska Investment Group, managed by Anand Parekh, holds the number one position in Walker & Dunlop Inc. (NYSE:WD). Alyeska Investment Group has a $11.9 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Royce & Associates, managed by Chuck Royce, which holds a $11.9 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass Jim Simons’s Renaissance Technologies, D. E. Shaw’s D E Shaw and Cliff Asness’s AQR Capital Management.

Judging by the fact that Walker & Dunlop Inc. (NYSE:WD) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there was a specific group of hedge funds that elected to cut their full holdings heading into Q3. Intriguingly, Ken Griffin’s Citadel Investment Group dumped the largest investment of all the hedgies watched by Insider Monkey, valued at an estimated $3.5 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $2.8 million worth. These transactions are interesting, as total hedge fund interest was cut by 7 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Walker & Dunlop Inc. (NYSE:WD) but similarly valued. We will take a look at Arcosa, Inc. (NYSE:ACA), Zai Lab Limited (NASDAQ:ZLAB), Air Transport Services Group Inc. (NASDAQ:ATSG), and Mueller Industries, Inc. (NYSE:MLI). This group of stocks’ market caps match WD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACA | 19 | 324000 | 19 |

| ZLAB | 16 | 162588 | -4 |

| ATSG | 13 | 210391 | -7 |

| MLI | 10 | 142048 | -5 |

| Average | 14.5 | 209757 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $210 million. That figure was $54 million in WD’s case. Arcosa, Inc. (NYSE:ACA) is the most popular stock in this table. On the other hand Mueller Industries, Inc. (NYSE:MLI) is the least popular one with only 10 bullish hedge fund positions. Walker & Dunlop Inc. (NYSE:WD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on WD as the stock returned 24.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.