“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Transocean Ltd (NYSE:RIG) investors should be aware of an increase in support from the world’s most elite money managers lately. Our calculations also showed that rig isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a multitude of tools shareholders have at their disposal to evaluate publicly traded companies. A pair of the most underrated tools are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the top investment managers can outpace the market by a healthy margin (see the details here).

Let’s check out the new hedge fund action surrounding Transocean Ltd (NYSE:RIG).

How have hedgies been trading Transocean Ltd (NYSE:RIG)?

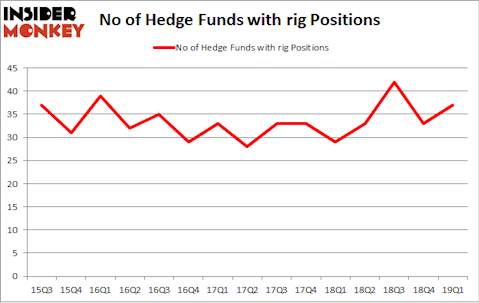

At Q1’s end, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards RIG over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Platinum Asset Management held the most valuable stake in Transocean Ltd (NYSE:RIG), which was worth $158.6 million at the end of the first quarter. On the second spot was Orbis Investment Management which amassed $115 million worth of shares. Moreover, Millennium Management, Avenue Capital, and Citadel Investment Group were also bullish on Transocean Ltd (NYSE:RIG), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Avenue Capital, managed by Marc Lasry, initiated the most outsized position in Transocean Ltd (NYSE:RIG). Avenue Capital had $67.7 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $7.3 million investment in the stock during the quarter. The following funds were also among the new RIG investors: Howard Marks’s Oaktree Capital Management, Steve Pattyn’s Yaupon Capital, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Transocean Ltd (NYSE:RIG). We will take a look at Hudson Pacific Properties Inc (NYSE:HPP), Lincoln Electric Holdings, Inc. (NASDAQ:LECO), EQT Corporation (NYSE:EQT), and Toll Brothers Inc (NYSE:TOL). This group of stocks’ market values are closest to RIG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HPP | 12 | 362610 | 0 |

| LECO | 26 | 308752 | 7 |

| EQT | 36 | 1181332 | -8 |

| TOL | 28 | 389774 | 0 |

| Average | 25.5 | 560617 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $561 million. That figure was $757 million in RIG’s case. EQT Corporation (NYSE:EQT) is the most popular stock in this table. On the other hand Hudson Pacific Properties Inc (NYSE:HPP) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Transocean Ltd (NYSE:RIG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately RIG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on RIG were disappointed as the stock returned -23.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.