Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 13.5% in the fourth quarter. Seven out of 11 industry groups in the S&P 500 Index were down more than 20% from their 52-week highs at the trough of the stock market crash. The average return of a randomly picked stock in the index was even worse. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 15 most popular S&P 500 stocks among hedge funds not only recouped their Q4 losses but also outperformed the index by more than 3 percentage points. In this article, we will take a look at what hedge funds think about Toll Brothers Inc (NYSE:TOL).

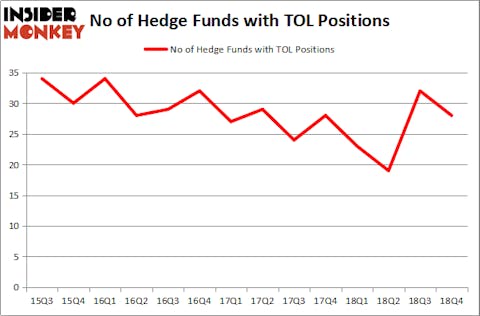

Is Toll Brothers Inc (NYSE:TOL) a bargain? The smart money is becoming less confident. The number of long hedge fund bets shrunk by 4 in recent months. Our calculations also showed that TOL isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the recent hedge fund action surrounding Toll Brothers Inc (NYSE:TOL).

What have hedge funds been doing with Toll Brothers Inc (NYSE:TOL)?

At Q4’s end, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TOL over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Greenhaven Associates was the largest shareholder of Toll Brothers Inc (NYSE:TOL), with a stake worth $144.1 million reported as of the end of September. Trailing Greenhaven Associates was Renaissance Technologies, which amassed a stake valued at $58.3 million. Millennium Management, Citadel Investment Group, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Because Toll Brothers Inc (NYSE:TOL) has witnessed falling interest from the smart money, it’s easy to see that there lies a certain “tier” of funds who were dropping their positions entirely by the end of the third quarter. Intriguingly, Greg Poole’s Echo Street Capital Management cut the biggest position of the “upper crust” of funds tracked by Insider Monkey, valued at an estimated $29 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund cut about $13.8 million worth. These transactions are important to note, as total hedge fund interest was cut by 4 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Toll Brothers Inc (NYSE:TOL). We will take a look at WPX Energy Inc (NYSE:WPX), EPR Properties (NYSE:EPR), The Goodyear Tire & Rubber Company (NASDAQ:GT), and United Therapeutics Corporation (NASDAQ:UTHR). All of these stocks’ market caps match TOL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WPX | 46 | 727535 | -7 |

| EPR | 22 | 155570 | 9 |

| GT | 30 | 589242 | 5 |

| UTHR | 23 | 972269 | 5 |

| Average | 30.25 | 611154 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $611 million. That figure was $445 million in TOL’s case. WPX Energy Inc (NYSE:WPX) is the most popular stock in this table. On the other hand EPR Properties (NYSE:EPR) is the least popular one with only 22 bullish hedge fund positions. Toll Brothers Inc (NYSE:TOL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on TOL, though not to the same extent, as the stock returned 16.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.