Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Toll Brothers Inc (NYSE:TOL) to find out whether it was one of their high conviction long-term ideas.

Toll Brothers Inc (NYSE:TOL) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 28 hedge funds’ portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Bilibili Inc. (NASDAQ:BILI), Oshkosh Corporation (NYSE:OSK), and National Fuel Gas Company (NYSE:NFG) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action encompassing Toll Brothers Inc (NYSE:TOL).

How have hedgies been trading Toll Brothers Inc (NYSE:TOL)?

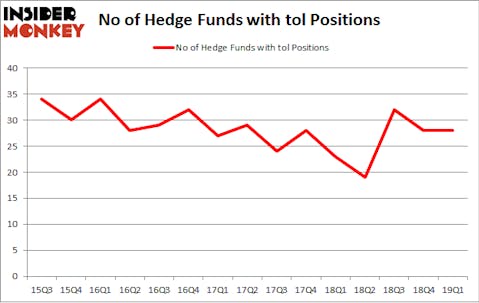

Heading into the second quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards TOL over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Toll Brothers Inc (NYSE:TOL) was held by Greenhaven Associates, which reported holding $157.1 million worth of stock at the end of March. It was followed by AQR Capital Management with a $68.3 million position. Other investors bullish on the company included D E Shaw, Citadel Investment Group, and Renaissance Technologies.

Because Toll Brothers Inc (NYSE:TOL) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there were a few money managers that decided to sell off their entire stakes last quarter. At the top of the heap, Anthony Bozza’s Lakewood Capital Management said goodbye to the largest stake of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $24.9 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund cut about $10.8 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Toll Brothers Inc (NYSE:TOL) but similarly valued. These stocks are Bilibili Inc. (NASDAQ:BILI), Oshkosh Corporation (NYSE:OSK), National Fuel Gas Company (NYSE:NFG), and Huntsman Corporation (NYSE:HUN). This group of stocks’ market valuations are closest to TOL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BILI | 22 | 448742 | 2 |

| OSK | 24 | 353710 | -5 |

| NFG | 16 | 236763 | 0 |

| HUN | 35 | 470004 | 9 |

| Average | 24.25 | 377305 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $377 million. That figure was $390 million in TOL’s case. Huntsman Corporation (NYSE:HUN) is the most popular stock in this table. On the other hand National Fuel Gas Company (NYSE:NFG) is the least popular one with only 16 bullish hedge fund positions. Toll Brothers Inc (NYSE:TOL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TOL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TOL were disappointed as the stock returned -1.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.