We can judge whether The Stars Group Inc. (NASDAQ:TSG) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

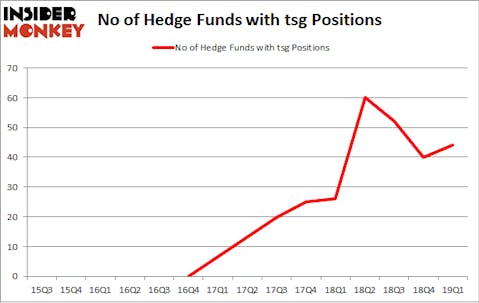

The Stars Group Inc. (NASDAQ:TSG) has experienced an increase in hedge fund interest in recent months. TSG was in 44 hedge funds’ portfolios at the end of the first quarter of 2019. There were 40 hedge funds in our database with TSG positions at the end of the previous quarter. Our calculations also showed that tsg isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are tons of methods market participants use to analyze stocks. A pair of the most useful methods are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top money managers can trounce the market by a superb margin (see the details here).

We’re going to analyze the recent hedge fund action surrounding The Stars Group Inc. (NASDAQ:TSG).

How are hedge funds trading The Stars Group Inc. (NASDAQ:TSG)?

At the end of the first quarter, a total of 44 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TSG over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in The Stars Group Inc. (NASDAQ:TSG) was held by HG Vora Capital Management, which reported holding $131.3 million worth of stock at the end of March. It was followed by Odey Asset Management Group with a $107.6 million position. Other investors bullish on the company included Tiger Legatus Capital, Indus Capital, and Harbor Spring Capital.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. HG Vora Capital Management, managed by Parag Vora, created the most valuable position in The Stars Group Inc. (NASDAQ:TSG). HG Vora Capital Management had $131.3 million invested in the company at the end of the quarter. Amit Nitin Doshi’s Harbor Spring Capital also made a $58.4 million investment in the stock during the quarter. The other funds with brand new TSG positions are Robert Pohly’s Samlyn Capital, Larry Robbins’s Glenview Capital, and Andrew Bellas’s General Equity Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The Stars Group Inc. (NASDAQ:TSG) but similarly valued. These stocks are InterXion Holding NV (NYSE:INXN), argenx SE (NASDAQ:ARGX), Integra Lifesciences Holdings Corp (NASDAQ:IART), and The Howard Hughes Corporation (NYSE:HHC). All of these stocks’ market caps are similar to TSG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INXN | 25 | 741670 | -3 |

| ARGX | 24 | 750610 | -3 |

| IART | 19 | 159928 | 1 |

| HHC | 22 | 471962 | -4 |

| Average | 22.5 | 531043 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $531 million. That figure was $903 million in TSG’s case. InterXion Holding NV (NYSE:INXN) is the most popular stock in this table. On the other hand Integra Lifesciences Holdings Corp (NASDAQ:IART) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks The Stars Group Inc. (NASDAQ:TSG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TSG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TSG were disappointed as the stock returned -6.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.