With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was The Hackett Group, Inc. (NASDAQ:HCKT).

The Hackett Group, Inc. (NASDAQ:HCKT) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as J.C. Penney Company, Inc. (NYSE:JCP), Ready Capital Corporation (NYSE:RC), and Petmed Express Inc (NASDAQ:PETS) to gather more data points.

If you’d ask most stock holders, hedge funds are assumed to be unimportant, old investment tools of yesteryear. While there are over 8000 funds with their doors open today, Our researchers choose to focus on the top tier of this club, around 750 funds. Most estimates calculate that this group of people administer bulk of the smart money’s total capital, and by tracking their best investments, Insider Monkey has formulated a few investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the latest hedge fund action surrounding The Hackett Group, Inc. (NASDAQ:HCKT).

What does smart money think about The Hackett Group, Inc. (NASDAQ:HCKT)?

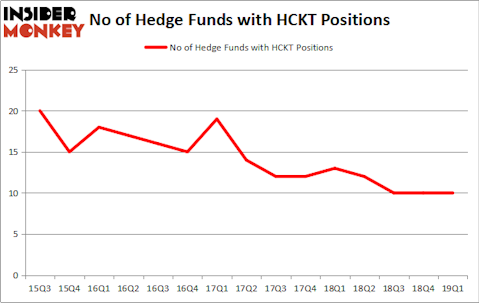

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HCKT over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Trigran Investments held the most valuable stake in The Hackett Group, Inc. (NASDAQ:HCKT), which was worth $25.6 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $16.7 million worth of shares. Moreover, Royce & Associates, AQR Capital Management, and GLG Partners were also bullish on The Hackett Group, Inc. (NASDAQ:HCKT), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Citadel Investment Group. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Arrowstreet Capital).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The Hackett Group, Inc. (NASDAQ:HCKT) but similarly valued. These stocks are J.C. Penney Company, Inc. (NYSE:JCP), Ready Capital Corporation (NYSE:RC), Petmed Express Inc (NASDAQ:PETS), and Corenergy Infrastructure Trust Inc (NYSE:CORR). This group of stocks’ market values are similar to HCKT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JCP | 13 | 45079 | -4 |

| RC | 14 | 63305 | 8 |

| PETS | 16 | 74107 | 1 |

| CORR | 11 | 43465 | 4 |

| Average | 13.5 | 56489 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $56 million. That figure was $61 million in HCKT’s case. Petmed Express Inc (NASDAQ:PETS) is the most popular stock in this table. On the other hand Corenergy Infrastructure Trust Inc (NYSE:CORR) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks The Hackett Group, Inc. (NASDAQ:HCKT) is even less popular than CORR. Hedge funds clearly dropped the ball on HCKT as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on HCKT as the stock returned 9.5% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.