Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Sutro Biopharma, Inc. (NASDAQ:STRO).

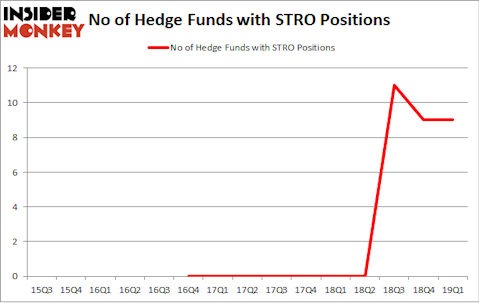

Sutro Biopharma, Inc. (NASDAQ:STRO) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of March. At the end of this article we will also compare STRO to other stocks including Great Ajax Corp (NYSE:AJX), Territorial Bancorp Inc (NASDAQ:TBNK), and Synchronoss Technologies, Inc. (NASDAQ:SNCR) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the fresh hedge fund action regarding Sutro Biopharma, Inc. (NASDAQ:STRO).

How are hedge funds trading Sutro Biopharma, Inc. (NASDAQ:STRO)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in STRO a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Ken Griffin’s Citadel Investment Group has the number one position in Sutro Biopharma, Inc. (NASDAQ:STRO), worth close to $19.7 million, corresponding to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Samsara BioCapital, managed by Srini AkkarajuáandáMichael Dybbs, which holds a $12.8 million position; 10.1% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors with similar optimism include Stephen DuBois’s Camber Capital Management, Michael Castor’s Sio Capital and Richard Driehaus’s Driehaus Capital.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Nexthera Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Millennium Management).

Let’s also examine hedge fund activity in other stocks similar to Sutro Biopharma, Inc. (NASDAQ:STRO). These stocks are Great Ajax Corp (NYSE:AJX), Territorial Bancorp Inc (NASDAQ:TBNK), Synchronoss Technologies, Inc. (NASDAQ:SNCR), and Savara, Inc. (NASDAQ:SVRA). This group of stocks’ market values match STRO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AJX | 4 | 15320 | 0 |

| TBNK | 3 | 20579 | -1 |

| SNCR | 12 | 25724 | 0 |

| SVRA | 13 | 63694 | 1 |

| Average | 8 | 31329 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $49 million in STRO’s case. Savara, Inc. (NASDAQ:SVRA) is the most popular stock in this table. On the other hand Territorial Bancorp Inc (NASDAQ:TBNK) is the least popular one with only 3 bullish hedge fund positions. Sutro Biopharma, Inc. (NASDAQ:STRO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on STRO, though not to the same extent, as the stock returned 4.2% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.