Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Sterling Construction Company, Inc. (NASDAQ:STRL) from the perspective of those elite funds.

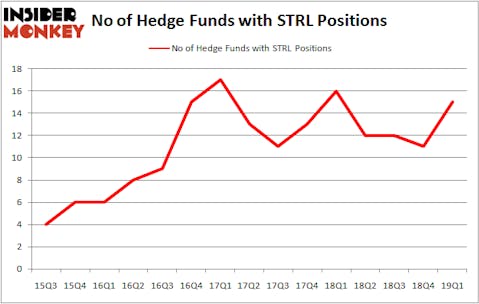

Is Sterling Construction Company, Inc. (NASDAQ:STRL) going to take off soon? The smart money is buying. The number of bullish hedge fund positions rose by 4 recently. Our calculations also showed that STRL isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most traders, hedge funds are seen as worthless, old financial vehicles of yesteryear. While there are over 8000 funds in operation at the moment, Our experts choose to focus on the aristocrats of this group, approximately 750 funds. These money managers preside over the majority of all hedge funds’ total capital, and by observing their best investments, Insider Monkey has formulated numerous investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a gander at the key hedge fund action surrounding Sterling Construction Company, Inc. (NASDAQ:STRL).

How have hedgies been trading Sterling Construction Company, Inc. (NASDAQ:STRL)?

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in STRL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Sterling Construction Company, Inc. (NASDAQ:STRL), which was worth $26.3 million at the end of the first quarter. On the second spot was Royce & Associates which amassed $7 million worth of shares. Moreover, Driehaus Capital, AlphaOne Capital Partners, and Two Sigma Advisors were also bullish on Sterling Construction Company, Inc. (NASDAQ:STRL), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. GLG Partners, managed by Noam Gottesman, assembled the most valuable position in Sterling Construction Company, Inc. (NASDAQ:STRL). GLG Partners had $1.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $1.2 million position during the quarter. The other funds with brand new STRL positions are Jeffrey Talpins’s Element Capital Management and David Harding’s Winton Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Sterling Construction Company, Inc. (NASDAQ:STRL) but similarly valued. These stocks are Utah Medical Products, Inc. (NASDAQ:UTMD), Daseke, Inc. (NASDAQ:DSKE), Powell Industries, Inc. (NASDAQ:POWL), and Tilly’s Inc (NYSE:TLYS). All of these stocks’ market caps resemble STRL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UTMD | 8 | 32509 | 0 |

| DSKE | 9 | 9685 | 0 |

| POWL | 9 | 21074 | 1 |

| TLYS | 16 | 64259 | 1 |

| Average | 10.5 | 31882 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $51 million in STRL’s case. Tilly’s Inc (NYSE:TLYS) is the most popular stock in this table. On the other hand Utah Medical Products, Inc. (NASDAQ:UTMD) is the least popular one with only 8 bullish hedge fund positions. Sterling Construction Company, Inc. (NASDAQ:STRL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on STRL as the stock returned 7.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.