World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

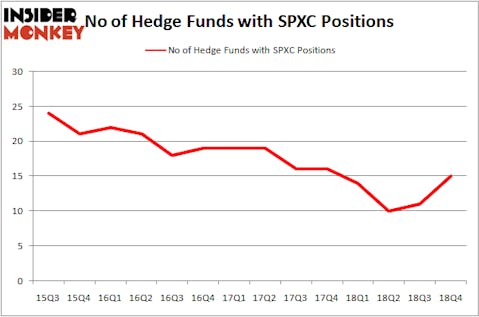

SPX Corporation (NYSE:SPXC) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that SPXC isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several indicators stock market investors can use to size up their holdings. A couple of the less utilized indicators are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can beat the S&P 500 by a healthy amount (see the details here).

We’re going to take a peek at the key hedge fund action encompassing SPX Corporation (NYSE:SPXC).

How are hedge funds trading SPX Corporation (NYSE:SPXC)?

At the end of the fourth quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from the previous quarter. By comparison, 14 hedge funds held shares or bullish call options in SPXC a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

The largest stake in SPX Corporation (NYSE:SPXC) was held by Selz Capital, which reported holding $26.6 million worth of stock at the end of December. It was followed by Corsair Capital Management with a $17.4 million position. Other investors bullish on the company included D E Shaw, Ancora Advisors, and Millennium Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Adage Capital Management, managed by Phill Gross and Robert Atchinson, initiated the biggest position in SPX Corporation (NYSE:SPXC). Adage Capital Management had $3.2 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $3 million investment in the stock during the quarter. The following funds were also among the new SPXC investors: Gregg Moskowitz’s Interval Partners, Brandon Haley’s Holocene Advisors, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks similar to SPX Corporation (NYSE:SPXC). We will take a look at MaxLinear, Inc. (NYSE:MXL), Hortonworks Inc (NASDAQ:HDP), Oxford Industries, Inc. (NYSE:OXM), and Vocera Communications Inc (NYSE:VCRA). This group of stocks’ market caps match SPXC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MXL | 5 | 19902 | 1 |

| HDP | 20 | 193198 | -7 |

| OXM | 9 | 52653 | -4 |

| VCRA | 17 | 103411 | 6 |

| Average | 12.75 | 92291 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $93 million in SPXC’s case. Hortonworks Inc (NASDAQ:HDP) is the most popular stock in this table. On the other hand MaxLinear, Inc. (NYSE:MXL) is the least popular one with only 5 bullish hedge fund positions. SPX Corporation (NYSE:SPXC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on SPXC as the stock returned 30.4% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.