It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards SM Energy Company (NYSE:SM) during the quarter below.

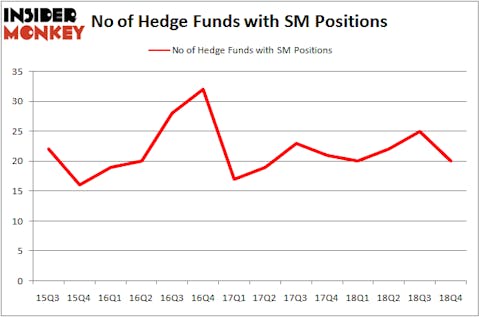

SM Energy Company (NYSE:SM) has experienced a decrease in enthusiasm from smart money lately. Our calculations also showed that SM isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are numerous indicators investors employ to assess publicly traded companies. A pair of the less known indicators are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outperform the S&P 500 by a solid amount (see the details here).

We’re going to view the new hedge fund action encompassing SM Energy Company (NYSE:SM).

What does the smart money think about SM Energy Company (NYSE:SM)?

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from one quarter earlier. By comparison, 20 hedge funds held shares or bullish call options in SM a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in SM Energy Company (NYSE:SM), which was worth $133.3 million at the end of the fourth quarter. On the second spot was AQR Capital Management which amassed $33.7 million worth of shares. Moreover, Renaissance Technologies, Citadel Investment Group, and D E Shaw were also bullish on SM Energy Company (NYSE:SM), allocating a large percentage of their portfolios to this stock.

Judging by the fact that SM Energy Company (NYSE:SM) has experienced a decline in interest from hedge fund managers, we can see that there is a sect of fund managers that slashed their entire stakes last quarter. At the top of the heap, John Labanowski’s Brenham Capital Management said goodbye to the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at about $88 million in stock, and Howard Marks’s Oaktree Capital Management was right behind this move, as the fund said goodbye to about $10.4 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as SM Energy Company (NYSE:SM) but similarly valued. These stocks are Supernus Pharmaceuticals Inc (NASDAQ:SUPN), Crocs, Inc. (NASDAQ:CROX), Realogy Holdings Corp (NYSE:RLGY), and Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL). This group of stocks’ market values are similar to SM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SUPN | 15 | 56322 | 1 |

| CROX | 26 | 340892 | -1 |

| RLGY | 20 | 445074 | -3 |

| MDGL | 19 | 287555 | -7 |

| Average | 20 | 282461 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $306 million in SM’s case. Crocs, Inc. (NASDAQ:CROX) is the most popular stock in this table. On the other hand Supernus Pharmaceuticals Inc (NASDAQ:SUPN) is the least popular one with only 15 bullish hedge fund positions. SM Energy Company (NYSE:SM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on SM, though not to the same extent, as the stock returned 19.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.