A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of SiteOne Landscape Supply, Inc. (NYSE:SITE) during the quarter.

Is SiteOne Landscape Supply, Inc. (NYSE:SITE) a buy, sell, or hold? The best stock pickers are selling. The number of long hedge fund bets decreased by 4 in recent months. Our calculations also showed that SITE isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action encompassing SiteOne Landscape Supply, Inc. (NYSE:SITE).

What does the smart money think about SiteOne Landscape Supply, Inc. (NYSE:SITE)?

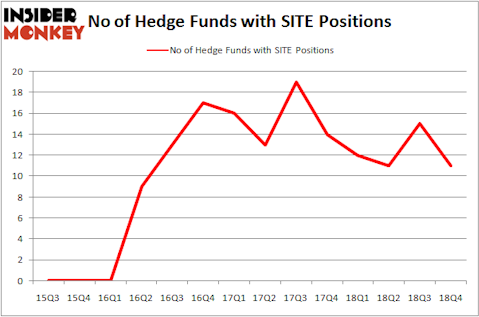

At Q4’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SITE over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in SiteOne Landscape Supply, Inc. (NYSE:SITE), which was worth $15.3 million at the end of the third quarter. On the second spot was Driehaus Capital which amassed $6.2 million worth of shares. Moreover, Diker Management, Citadel Investment Group, and Lionstone Capital Management were also bullish on SiteOne Landscape Supply, Inc. (NYSE:SITE), allocating a large percentage of their portfolios to this stock.

Judging by the fact that SiteOne Landscape Supply, Inc. (NYSE:SITE) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies that decided to sell off their positions entirely last quarter. At the top of the heap, Mark Moore’s ThornTree Capital Partners dumped the largest position of the 700 funds tracked by Insider Monkey, totaling close to $29.6 million in stock. Malcolm Fairbairn’s fund, Ascend Capital, also said goodbye to its stock, about $16.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 4 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as SiteOne Landscape Supply, Inc. (NYSE:SITE) but similarly valued. We will take a look at Alliance Resource Partners, L.P. (NASDAQ:ARLP), Tempur Sealy International Inc. (NYSE:TPX), Patterson-UTI Energy, Inc. (NASDAQ:PTEN), and frontdoor, inc. (NASDAQ:FTDR). All of these stocks’ market caps resemble SITE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARLP | 8 | 96584 | -1 |

| TPX | 31 | 1015114 | 1 |

| PTEN | 39 | 235916 | 8 |

| FTDR | 24 | 189778 | 22 |

| Average | 25.5 | 384348 | 7.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $384 million. That figure was $38 million in SITE’s case. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is the most popular stock in this table. On the other hand Alliance Resource Partners, L.P. (NASDAQ:ARLP) is the least popular one with only 8 bullish hedge fund positions. SiteOne Landscape Supply, Inc. (NYSE:SITE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately SITE wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); SITE investors were disappointed as the stock returned 15.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.