A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) during the quarter.

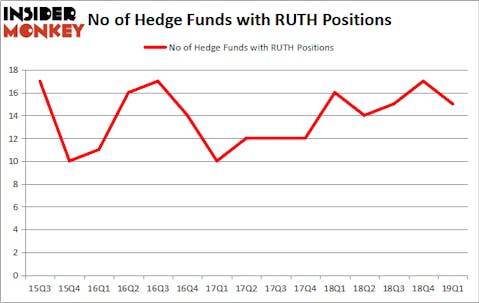

Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) was in 15 hedge funds’ portfolios at the end of March. RUTH shareholders have witnessed a decrease in hedge fund interest recently. There were 17 hedge funds in our database with RUTH positions at the end of the previous quarter. Our calculations also showed that RUTH isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a multitude of signals stock market investors put to use to evaluate stocks. Some of the most innovative signals are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can outpace the market by a superb amount (see the details here).

Let’s take a glance at the fresh hedge fund action surrounding Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH).

How are hedge funds trading Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RUTH over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the largest position in Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH), worth close to $15.7 million, corresponding to less than 0.1%% of its total 13F portfolio. Coming in second is Cliff Asness of AQR Capital Management, with a $11.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish encompass Noam Gottesman’s GLG Partners, Israel Englander’s Millennium Management and Lee Ainslie’s Maverick Capital.

Because Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) has faced bearish sentiment from hedge fund managers, we can see that there exists a select few fund managers that decided to sell off their full holdings by the end of the third quarter. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the biggest stake of all the hedgies followed by Insider Monkey, totaling close to $0.6 million in stock. Minhua Zhang’s fund, Weld Capital Management, also sold off its stock, about $0.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH). We will take a look at Meta Financial Group Inc. (NASDAQ:CASH), Solaris Oilfield Infrastructure, Inc. (NYSE:SOI), Cellectis SA (NASDAQ:CLLS), and OneSpan Inc. (NASDAQ:OSPN). All of these stocks’ market caps resemble RUTH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CASH | 12 | 82203 | -1 |

| SOI | 16 | 102118 | 1 |

| CLLS | 8 | 32826 | 0 |

| OSPN | 13 | 71319 | 1 |

| Average | 12.25 | 72117 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $72 million. That figure was $65 million in RUTH’s case. Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) is the most popular stock in this table. On the other hand Cellectis SA (NASDAQ:CLLS) is the least popular one with only 8 bullish hedge fund positions. Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately RUTH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on RUTH were disappointed as the stock returned -10.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.