Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB).

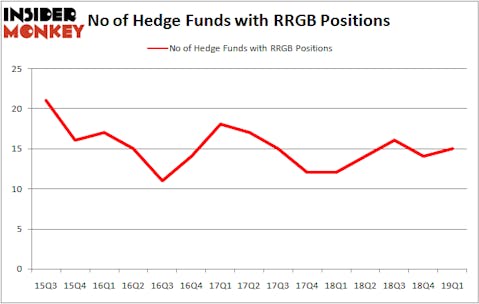

Is Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) a worthy investment now? Hedge funds are getting more optimistic. The number of long hedge fund bets rose by 1 in recent months. Our calculations also showed that RRGB isn’t among the 30 most popular stocks among hedge funds. RRGB was in 15 hedge funds’ portfolios at the end of March. There were 14 hedge funds in our database with RRGB holdings at the end of the previous quarter.

Today there are a multitude of methods stock traders employ to appraise publicly traded companies. A duo of the less known methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outperform the market by a healthy margin (see the details here).

We’re going to go over the recent hedge fund action encompassing Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB).

Hedge fund activity in Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB)

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RRGB over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB), with a stake worth $12.9 million reported as of the end of March. Trailing Citadel Investment Group was Millennium Management, which amassed a stake valued at $12.6 million. Arrowstreet Capital, Balyasny Asset Management, and GMT Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, created the biggest position in Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB). Balyasny Asset Management had $3.2 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Frederick DiSanto’s Ancora Advisors, Chuck Royce’s Royce & Associates, and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) but similarly valued. These stocks are Del Taco Restaurants Inc (NASDAQ:TACO), 3PEA International, Inc. (NASDAQ:TPNL), Cardlytics, Inc. (NASDAQ:CDLX), and Zix Corporation (NASDAQ:ZIXI). This group of stocks’ market valuations are similar to RRGB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TACO | 14 | 20221 | -4 |

| TPNL | 6 | 8071 | 3 |

| CDLX | 9 | 26098 | 3 |

| ZIXI | 21 | 70511 | 8 |

| Average | 12.5 | 31225 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $47 million in RRGB’s case. Zix Corporation (NASDAQ:ZIXI) is the most popular stock in this table. On the other hand 3PEA International, Inc. (NASDAQ:TPNL) is the least popular one with only 6 bullish hedge fund positions. Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on RRGB as the stock returned 7.9% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.