At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Realty Income Corporation (NYSE:O) makes for a good investment right now.

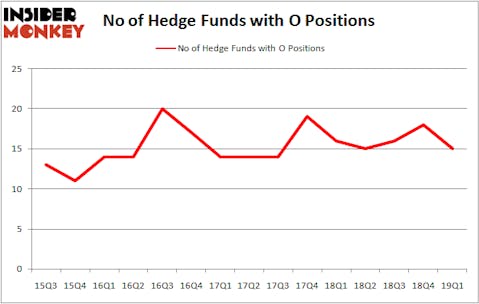

Realty Income Corporation (NYSE:O) shareholders have witnessed a decrease in enthusiasm from smart money lately. O was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. There were 18 hedge funds in our database with O holdings at the end of the previous quarter. Our calculations also showed that O isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are perceived as unimportant, outdated investment tools of years past. While there are greater than 8000 funds with their doors open at present, We look at the upper echelon of this club, about 750 funds. These hedge fund managers command most of all hedge funds’ total asset base, and by following their highest performing investments, Insider Monkey has discovered many investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a peek at the new hedge fund action surrounding Realty Income Corporation (NYSE:O).

How are hedge funds trading Realty Income Corporation (NYSE:O)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -17% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in O a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Zimmer Partners held the most valuable stake in Realty Income Corporation (NYSE:O), which was worth $73.6 million at the end of the first quarter. On the second spot was Point72 Asset Management which amassed $31.9 million worth of shares. Moreover, Adage Capital Management, AQR Capital Management, and Citadel Investment Group were also bullish on Realty Income Corporation (NYSE:O), allocating a large percentage of their portfolios to this stock.

Because Realty Income Corporation (NYSE:O) has faced declining sentiment from the entirety of the hedge funds we track, logic holds that there is a sect of hedge funds who were dropping their full holdings by the end of the third quarter. Intriguingly, Jasjit Rekhi’s Sanoor Capital sold off the largest investment of all the hedgies followed by Insider Monkey, worth close to $6.3 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also said goodbye to its stock, about $6 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Realty Income Corporation (NYSE:O) but similarly valued. We will take a look at Concho Resources Inc. (NYSE:CXO), TELUS Corporation (NYSE:TU), Parker-Hannifin Corporation (NYSE:PH), and FirstEnergy Corp. (NYSE:FE). This group of stocks’ market caps are similar to O’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CXO | 26 | 530505 | -9 |

| TU | 13 | 336110 | 2 |

| PH | 28 | 516590 | -2 |

| FE | 41 | 3727862 | 2 |

| Average | 27 | 1277767 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $1278 million. That figure was $176 million in O’s case. FirstEnergy Corp. (NYSE:FE) is the most popular stock in this table. On the other hand TELUS Corporation (NYSE:TU) is the least popular one with only 13 bullish hedge fund positions. Realty Income Corporation (NYSE:O) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately O wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); O investors were disappointed as the stock returned 0.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.