Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

Hedge fund interest in Prudential Financial Inc (NYSE:PRU) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as AFLAC Incorporated (NYSE:AFL), American International Group Inc (NYSE:AIG), and Koninklijke Philips NV (NYSE:PHG) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the latest hedge fund action surrounding Prudential Financial Inc (NYSE:PRU).

Hedge fund activity in Prudential Financial Inc (NYSE:PRU)

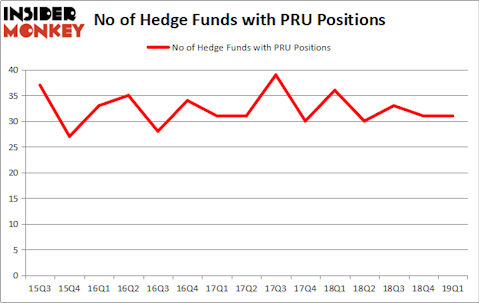

At Q1’s end, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PRU over the last 15 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in Prudential Financial Inc (NYSE:PRU), worth close to $99.4 million, comprising 0.1% of its total 13F portfolio. The second most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $51.8 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other peers that are bullish comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Noam Gottesman’s GLG Partners and Phill Gross and Robert Atchinson’s Adage Capital Management.

Judging by the fact that Prudential Financial Inc (NYSE:PRU) has experienced bearish sentiment from the smart money, it’s safe to say that there were a few money managers that decided to sell off their entire stakes heading into Q3. It’s worth mentioning that Benjamin A. Smith’s Laurion Capital Management dropped the largest position of the “upper crust” of funds tracked by Insider Monkey, valued at about $6.1 million in call options, and Nick Niell’s Arrowgrass Capital Partners was right behind this move, as the fund dumped about $5.5 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Prudential Financial Inc (NYSE:PRU). We will take a look at AFLAC Incorporated (NYSE:AFL), American International Group Inc (NYSE:AIG), Koninklijke Philips NV (NYSE:PHG), and ICICI Bank Limited (NYSE:IBN). This group of stocks’ market valuations are closest to PRU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFL | 30 | 737691 | 3 |

| AIG | 37 | 1792752 | -2 |

| PHG | 11 | 158586 | -3 |

| IBN | 26 | 744012 | 0 |

| Average | 26 | 858260 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $858 million. That figure was $513 million in PRU’s case. American International Group Inc (NYSE:AIG) is the most popular stock in this table. On the other hand Koninklijke Philips NV (NYSE:PHG) is the least popular one with only 11 bullish hedge fund positions. Prudential Financial Inc (NYSE:PRU) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on PRU as the stock returned 5.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.