Is Proto Labs Inc (NYSE:PRLB) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

Proto Labs Inc (NYSE:PRLB) has seen an increase in enthusiasm from smart money lately. Our calculations also showed that prlb isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the recent hedge fund action surrounding Proto Labs Inc (NYSE:PRLB).

Hedge fund activity in Proto Labs Inc (NYSE:PRLB)

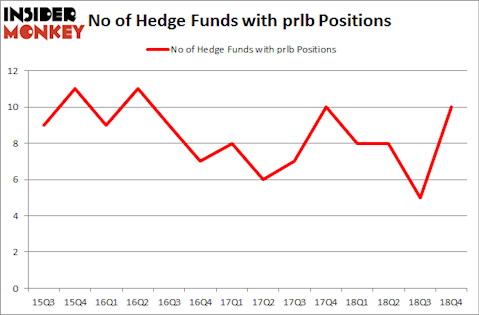

Heading into the first quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 100% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PRLB over the last 14 quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Proto Labs Inc (NYSE:PRLB), which was worth $8.1 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $4.9 million worth of shares. Moreover, D E Shaw, Royce & Associates, and Millennium Management were also bullish on Proto Labs Inc (NYSE:PRLB), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names were breaking ground themselves. Renaissance Technologies, managed by Jim Simons, initiated the most outsized position in Proto Labs Inc (NYSE:PRLB). Renaissance Technologies had $8.1 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $2 million investment in the stock during the quarter. The other funds with brand new PRLB positions are Matthew Hulsizer’s PEAK6 Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Noam Gottesman’s GLG Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Proto Labs Inc (NYSE:PRLB) but similarly valued. These stocks are Aaron’s, Inc. (NYSE:AAN), Centennial Resource Development, Inc. (NASDAQ:CDEV), UMB Financial Corporation (NASDAQ:UMBF), and Array Biopharma Inc (NASDAQ:ARRY). This group of stocks’ market valuations resemble PRLB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AAN | 21 | 186605 | 3 |

| CDEV | 14 | 137178 | -7 |

| UMBF | 11 | 49606 | 0 |

| ARRY | 31 | 787434 | 1 |

| Average | 19.25 | 290206 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $290 million. That figure was $21 million in PRLB’s case. Array Biopharma Inc (NASDAQ:ARRY) is the most popular stock in this table. On the other hand UMB Financial Corporation (NASDAQ:UMBF) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Proto Labs Inc (NYSE:PRLB) is even less popular than UMBF. Hedge funds dodged a bullet by taking a bearish stance towards PRLB. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PRLB wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); PRLB investors were disappointed as the stock returned 0.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.