Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 9 months of this year through September 30th the Standard and Poor’s 500 Index returned approximately 20% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 24% during the same 9-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Prospect Capital Corporation (NASDAQ:PSEC).

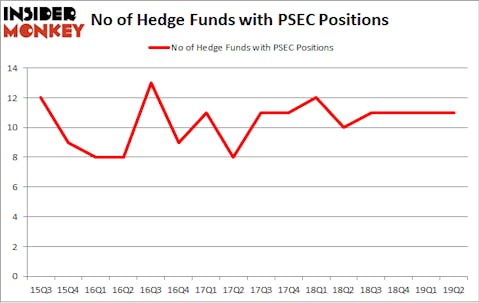

Prospect Capital Corporation (NASDAQ:PSEC) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of June. At the end of this article we will also compare PSEC to other stocks including Kosmos Energy Ltd (NYSE:KOS), Xenia Hotels & Resorts Inc (NYSE:XHR), and Seritage Growth Properties (NYSE:SRG) to get a better sense of its popularity. Our calculations also showed that PSEC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of methods stock traders use to assess publicly traded companies. A couple of the best methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can outpace their index-focused peers by a significant amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the fresh hedge fund action regarding Prospect Capital Corporation (NASDAQ:PSEC).

What have hedge funds been doing with Prospect Capital Corporation (NASDAQ:PSEC)?

At the end of the second quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in PSEC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Prospect Capital Corporation (NASDAQ:PSEC) was held by Arrowstreet Capital, which reported holding $10.5 million worth of stock at the end of March. It was followed by McKinley Capital Management with a $5.5 million position. Other investors bullish on the company included Marshall Wace LLP, PEAK6 Capital Management, and Citadel Investment Group.

Because Prospect Capital Corporation (NASDAQ:PSEC) has faced bearish sentiment from the smart money, it’s easy to see that there was a specific group of hedgies that slashed their positions entirely last quarter. Interestingly, OZ Management dropped the biggest position of the 750 funds tracked by Insider Monkey, totaling about $6.4 million in stock. Michael Hintze’s fund, CQS Cayman LP, also cut its stock, about $3.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Prospect Capital Corporation (NASDAQ:PSEC). These stocks are Kosmos Energy Ltd (NYSE:KOS), Xenia Hotels & Resorts Inc (NYSE:XHR), Seritage Growth Properties (NYSE:SRG), and H.B. Fuller Company (NYSE:FUL). This group of stocks’ market values are similar to PSEC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KOS | 24 | 216270 | 6 |

| XHR | 12 | 37569 | 3 |

| SRG | 15 | 460506 | -2 |

| FUL | 12 | 126249 | -6 |

| Average | 15.75 | 210149 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $210 million. That figure was $23 million in PSEC’s case. Kosmos Energy Ltd (NYSE:KOS) is the most popular stock in this table. On the other hand Xenia Hotels & Resorts Inc (NYSE:XHR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Prospect Capital Corporation (NASDAQ:PSEC) is even less popular than XHR. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on PSEC, though not to the same extent, as the stock returned 3.7% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.