The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded PriceSmart, Inc. (NASDAQ:PSMT) based on those filings.

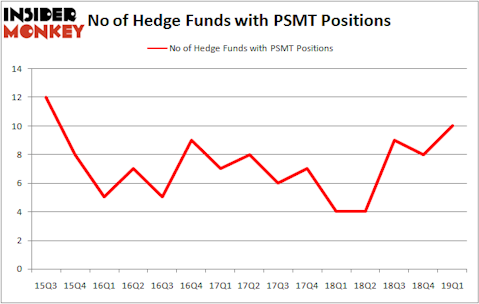

Is PriceSmart, Inc. (NASDAQ:PSMT) a buy right now? Investors who are in the know are in an optimistic mood. The number of bullish hedge fund positions improved by 2 recently. Our calculations also showed that PSMT isn’t among the 30 most popular stocks among hedge funds.

At the moment there are numerous methods market participants have at their disposal to assess stocks. A couple of the less utilized methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the elite hedge fund managers can outperform the S&P 500 by a healthy margin (see the details here).

Let’s review the key hedge fund action surrounding PriceSmart, Inc. (NASDAQ:PSMT).

What does smart money think about PriceSmart, Inc. (NASDAQ:PSMT)?

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. On the other hand, there were a total of 4 hedge funds with a bullish position in PSMT a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of PriceSmart, Inc. (NASDAQ:PSMT), with a stake worth $23.8 million reported as of the end of March. Trailing Renaissance Technologies was Citadel Investment Group, which amassed a stake valued at $6.1 million. Millennium Management, PEAK6 Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. D E Shaw, managed by D. E. Shaw, established the biggest position in PriceSmart, Inc. (NASDAQ:PSMT). D E Shaw had $1.1 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also made a $0.8 million investment in the stock during the quarter. The only other fund with a brand new PSMT position is Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now take a look at hedge fund activity in other stocks similar to PriceSmart, Inc. (NASDAQ:PSMT). We will take a look at BGC Partners, Inc. (NASDAQ:BGCP), TowneBank (NASDAQ:TOWN), Livent Corporation (NYSE:LTHM), and Tenneco Inc (NYSE:TEN). This group of stocks’ market valuations match PSMT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BGCP | 26 | 252988 | 3 |

| TOWN | 7 | 33308 | -1 |

| LTHM | 25 | 358707 | 15 |

| TEN | 26 | 195221 | 1 |

| Average | 21 | 210056 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $210 million. That figure was $42 million in PSMT’s case. BGC Partners, Inc. (NASDAQ:BGCP) is the most popular stock in this table. On the other hand TowneBank (NASDAQ:TOWN) is the least popular one with only 7 bullish hedge fund positions. PriceSmart, Inc. (NASDAQ:PSMT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately PSMT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); PSMT investors were disappointed as the stock returned -10.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.