The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Pinnacle West Capital Corporation (NYSE:PNW) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

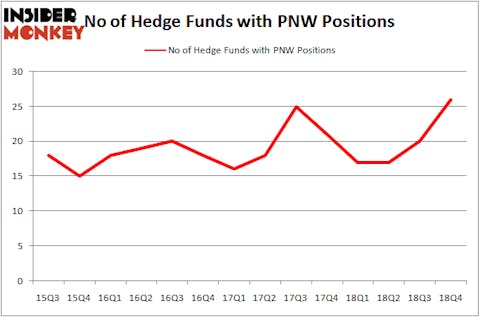

Pinnacle West Capital Corporation (NYSE:PNW) investors should pay attention to an increase in hedge fund sentiment lately. PNW was in 26 hedge funds’ portfolios at the end of December. There were 20 hedge funds in our database with PNW holdings at the end of the previous quarter. Our calculations also showed that PNW isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to view the new hedge fund action surrounding Pinnacle West Capital Corporation (NYSE:PNW).

How are hedge funds trading Pinnacle West Capital Corporation (NYSE:PNW)?

At Q4’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PNW over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in Pinnacle West Capital Corporation (NYSE:PNW), worth close to $269.4 million, comprising 0.3% of its total 13F portfolio. Coming in second is Cliff Asness of AQR Capital Management, with a $133.4 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism contain Phill Gross and Robert Atchinson’s Adage Capital Management, Israel Englander’s Millennium Management and Noam Gottesman’s GLG Partners.

As one would reasonably expect, specific money managers have jumped into Pinnacle West Capital Corporation (NYSE:PNW) headfirst. ExodusPoint Capital, managed by Michael Gelband, created the biggest position in Pinnacle West Capital Corporation (NYSE:PNW). ExodusPoint Capital had $12.9 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $4.3 million investment in the stock during the quarter. The other funds with brand new PNW positions are Joel Greenblatt’s Gotham Asset Management, Ray Dalio’s Bridgewater Associates, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Pinnacle West Capital Corporation (NYSE:PNW) but similarly valued. These stocks are Fibria Celulose SA (NYSE:FBR), Agnico Eagle Mines Limited (NYSE:AEM), Woori Financial Group Inc. (NYSE:WF), and NiSource Inc. (NYSE:NI). All of these stocks’ market caps resemble PNW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FBR | 3 | 177216 | -3 |

| AEM | 25 | 271170 | 10 |

| WF | 2 | 1557 | 2 |

| NI | 16 | 635424 | 3 |

| Average | 11.5 | 271342 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $271 million. That figure was $701 million in PNW’s case. Agnico Eagle Mines Limited (NYSE:AEM) is the most popular stock in this table. On the other hand Woori Financial Group Inc. (NYSE:WF) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Pinnacle West Capital Corporation (NYSE:PNW) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on PNW, though not to the same extent, as the stock returned 13.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.