Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 37.6% in 2019 (through the end of November) and outperformed the broader market benchmark by 9.9 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

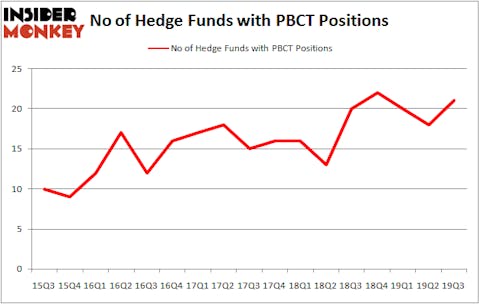

Is People’s United Financial, Inc. (NASDAQ:PBCT) worth your attention right now? Prominent investors are getting more bullish. The number of bullish hedge fund bets moved up by 3 recently. Our calculations also showed that PBCT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). PBCT was in 21 hedge funds’ portfolios at the end of the third quarter of 2019. There were 18 hedge funds in our database with PBCT holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the recent hedge fund action regarding People’s United Financial, Inc. (NASDAQ:PBCT).

How are hedge funds trading People’s United Financial, Inc. (NASDAQ:PBCT)?

Heading into the fourth quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the second quarter of 2019. On the other hand, there were a total of 20 hedge funds with a bullish position in PBCT a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Griffin’s Citadel Investment Group has the most valuable position in People’s United Financial, Inc. (NASDAQ:PBCT), worth close to $42.7 million, comprising less than 0.1%% of its total 13F portfolio. On Citadel Investment Group’s heels is Balyasny Asset Management, led by Dmitry Balyasny, holding a $25 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions contain Cliff Asness’s AQR Capital Management, Renaissance Technologies and Daniel Johnson’s Gillson Capital. In terms of the portfolio weights assigned to each position Castine Capital Management allocated the biggest weight to People’s United Financial, Inc. (NASDAQ:PBCT), around 3.08% of its 13F portfolio. Gillson Capital is also relatively very bullish on the stock, designating 1.25 percent of its 13F equity portfolio to PBCT.

As one would reasonably expect, key money managers were leading the bulls’ herd. Castine Capital Management, managed by Paul Magidson, Jonathan Cohen. And Ostrom Enders, assembled the most outsized position in People’s United Financial, Inc. (NASDAQ:PBCT). Castine Capital Management had $11.3 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also made a $0.8 million investment in the stock during the quarter. The other funds with brand new PBCT positions are Donald Sussman’s Paloma Partners, Minhua Zhang’s Weld Capital Management, and Matthew Tewksbury’s Stevens Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to People’s United Financial, Inc. (NASDAQ:PBCT). We will take a look at InterXion Holding NV (NYSE:INXN), PRA Health Sciences Inc (NASDAQ:PRAH), Arrow Electronics, Inc. (NYSE:ARW), and Unum Group (NYSE:UNM). This group of stocks’ market caps are similar to PBCT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INXN | 29 | 655643 | -5 |

| PRAH | 31 | 588717 | 6 |

| ARW | 22 | 536478 | 5 |

| UNM | 23 | 474210 | -2 |

| Average | 26.25 | 563762 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $564 million. That figure was $141 million in PBCT’s case. PRA Health Sciences Inc (NASDAQ:PRAH) is the most popular stock in this table. On the other hand Arrow Electronics, Inc. (NYSE:ARW) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks People’s United Financial, Inc. (NASDAQ:PBCT) is even less popular than ARW. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on PBCT, though not to the same extent, as the stock returned 6.6% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.