Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about PCSB Financial Corporation (NASDAQ:PCSB) in this article.

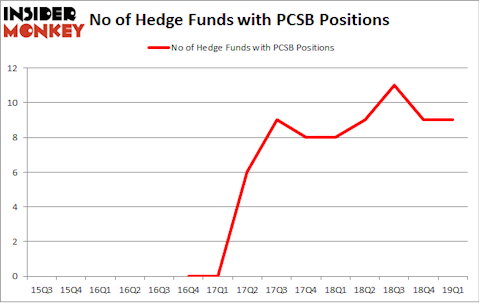

PCSB Financial Corporation (NASDAQ:PCSB) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare PCSB to other stocks including Unity Biotechnology, Inc. (NASDAQ:UBX), Titan Machinery Inc. (NASDAQ:TITN), and Artesian Resources Corporation (NASDAQ:ARTNA) to get a better sense of its popularity.

At the moment there are several gauges investors have at their disposal to size up stocks. Two of the most under-the-radar gauges are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best fund managers can outpace the S&P 500 by a significant margin (see the details here).

Let’s check out the new hedge fund action regarding PCSB Financial Corporation (NASDAQ:PCSB).

How are hedge funds trading PCSB Financial Corporation (NASDAQ:PCSB)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PCSB over the last 15 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management has the biggest position in PCSB Financial Corporation (NASDAQ:PCSB), worth close to $9.1 million, corresponding to 2.8% of its total 13F portfolio. Sitting at the No. 2 spot is Chuck Royce of Royce & Associates, with a $4.8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that hold long positions include Jim Simons’s Renaissance Technologies, John D. Gillespie’s Prospector Partners and Emanuel J. Friedman’s EJF Capital.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: MFP Investors. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Millennium Management).

Let’s now review hedge fund activity in other stocks similar to PCSB Financial Corporation (NASDAQ:PCSB). We will take a look at Unity Biotechnology, Inc. (NASDAQ:UBX), Titan Machinery Inc. (NASDAQ:TITN), Artesian Resources Corporation (NASDAQ:ARTNA), and Tuscan Holdings Corp. (NASDAQ:THCB). This group of stocks’ market valuations are closest to PCSB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBX | 4 | 9494 | 2 |

| TITN | 12 | 18228 | -3 |

| ARTNA | 3 | 17145 | -2 |

| THCB | 8 | 35955 | 8 |

| Average | 6.75 | 20206 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $26 million in PCSB’s case. Titan Machinery Inc. (NASDAQ:TITN) is the most popular stock in this table. On the other hand Artesian Resources Corporation (NASDAQ:ARTNA) is the least popular one with only 3 bullish hedge fund positions. PCSB Financial Corporation (NASDAQ:PCSB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately PCSB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PCSB were disappointed as the stock returned -1.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.