Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

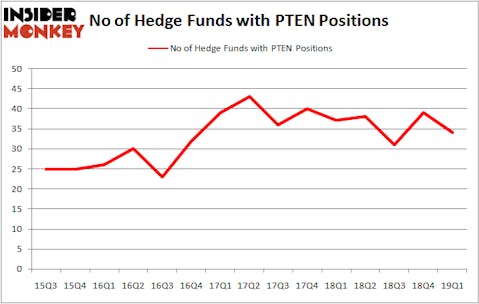

Is Patterson-UTI Energy, Inc. (NASDAQ:PTEN) a great investment today? The smart money is taking a bearish view. The number of bullish hedge fund positions shrunk by 5 recently. Our calculations also showed that PTEN isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the recent hedge fund action surrounding Patterson-UTI Energy, Inc. (NASDAQ:PTEN).

How have hedgies been trading Patterson-UTI Energy, Inc. (NASDAQ:PTEN)?

At Q1’s end, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the previous quarter. On the other hand, there were a total of 37 hedge funds with a bullish position in PTEN a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in Patterson-UTI Energy, Inc. (NASDAQ:PTEN). AQR Capital Management has a $87.6 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Jim Simons of Renaissance Technologies, with a $49.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions comprise Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and Ken Griffin’s Citadel Investment Group.

Seeing as Patterson-UTI Energy, Inc. (NASDAQ:PTEN) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there was a specific group of hedgies that decided to sell off their positions entirely heading into Q3. Interestingly, Irving Kahn’s Kahn Brothers dropped the largest investment of all the hedgies followed by Insider Monkey, valued at an estimated $16.6 million in stock. Andrew Axelrod’s fund, Axar Capital, also dumped its stock, about $7.6 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 5 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Patterson-UTI Energy, Inc. (NASDAQ:PTEN) but similarly valued. We will take a look at Balchem Corporation (NASDAQ:BCPC), Iridium Communications Inc. (NASDAQ:IRDM), Neogen Corporation (NASDAQ:NEOG), and Corelogic Inc (NYSE:CLGX). All of these stocks’ market caps are similar to PTEN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCPC | 7 | 63045 | -4 |

| IRDM | 12 | 139662 | -1 |

| NEOG | 12 | 32821 | -2 |

| CLGX | 17 | 310733 | -2 |

| Average | 12 | 136565 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $137 million. That figure was $301 million in PTEN’s case. Corelogic Inc (NYSE:CLGX) is the most popular stock in this table. On the other hand Balchem Corporation (NASDAQ:BCPC) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately PTEN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PTEN were disappointed as the stock returned -20.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.