It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Pacific Biosciences of California, Inc. (NASDAQ:PACB).

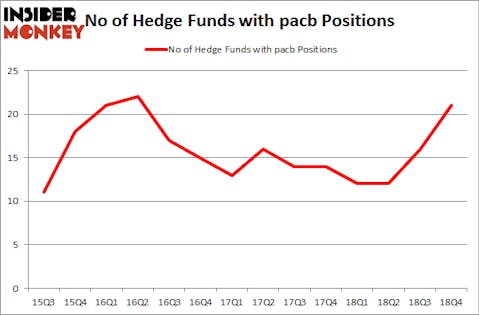

Is Pacific Biosciences of California, Inc. (NASDAQ:PACB) an excellent investment now? Hedge funds are taking a bullish view. The number of long hedge fund positions increased by 5 lately. Our calculations also showed that pacb isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a large number of metrics stock market investors put to use to value their stock investments. Some of the most useful metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite fund managers can trounce their index-focused peers by a significant margin (see the details here).

We’re going to go over the new hedge fund action regarding Pacific Biosciences of California, Inc. (NASDAQ:PACB).

How are hedge funds trading Pacific Biosciences of California, Inc. (NASDAQ:PACB)?

At Q4’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31% from the second quarter of 2018. On the other hand, there were a total of 12 hedge funds with a bullish position in PACB a year ago. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Magnetar Capital, managed by Alec Litowitz and Ross Laser, holds the largest position in Pacific Biosciences of California, Inc. (NASDAQ:PACB). Magnetar Capital has a $68.7 million position in the stock, comprising 1.7% of its 13F portfolio. Sitting at the No. 2 spot is Alpine Associates, led by Robert Emil Zoellner, holding a $31.5 million position; the fund has 1.3% of its 13F portfolio invested in the stock. Other peers that are bullish encompass Israel Englander’s Millennium Management, Mitchell Blutt’s Consonance Capital Management and D. E. Shaw’s D E Shaw.

As aggregate interest increased, key hedge funds were breaking ground themselves. Magnetar Capital, managed by Alec Litowitz and Ross Laser, assembled the most outsized position in Pacific Biosciences of California, Inc. (NASDAQ:PACB). Magnetar Capital had $68.7 million invested in the company at the end of the quarter. Robert Emil Zoellner’s Alpine Associates also initiated a $31.5 million position during the quarter. The other funds with new positions in the stock are Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, John Bader’s Halcyon Asset Management, and John Orrico’s Water Island Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Pacific Biosciences of California, Inc. (NASDAQ:PACB) but similarly valued. These stocks are MRC Global Inc (NYSE:MRC), Cooper-Standard Holdings Inc (NYSE:CPS), PRA Group, Inc. (NASDAQ:PRAA), and Heritage Financial Corporation (NASDAQ:HFWA). This group of stocks’ market valuations resemble PACB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRC | 15 | 112930 | -2 |

| CPS | 17 | 43113 | -8 |

| PRAA | 10 | 87363 | 3 |

| HFWA | 8 | 57644 | 2 |

| Average | 12.5 | 75263 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $75 million. That figure was $211 million in PACB’s case. Cooper-Standard Holdings Inc (NYSE:CPS) is the most popular stock in this table. On the other hand Heritage Financial Corporation (NASDAQ:HFWA) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Pacific Biosciences of California, Inc. (NASDAQ:PACB) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PACB wasn’t nearly as popular as these 15 stock and hedge funds that were betting on PACB were disappointed as the stock returned -1.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.