During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK) and see how the stock is affected by the recent hedge fund activity.

Is Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK) a great investment right now? Money managers are in a bullish mood. The number of long hedge fund positions moved up by 2 recently. Our calculations also showed that OLBK isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are assumed to be underperforming, outdated financial tools of yesteryear. While there are over 8000 funds with their doors open at present, Our experts hone in on the crème de la crème of this club, around 750 funds. It is estimated that this group of investors handle the majority of the hedge fund industry’s total asset base, and by shadowing their unrivaled picks, Insider Monkey has spotted various investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the new hedge fund action encompassing Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK).

What have hedge funds been doing with Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK)?

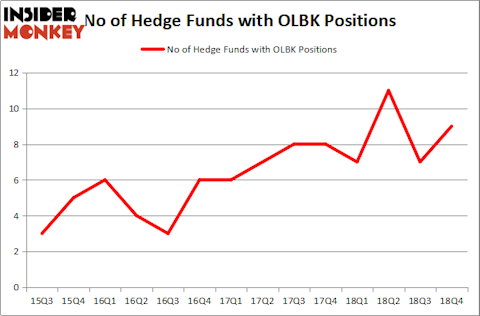

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OLBK over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Mendon Capital Advisors held the most valuable stake in Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK), which was worth $16.8 million at the end of the fourth quarter. On the second spot was Renaissance Technologies which amassed $10.8 million worth of shares. Moreover, Elizabeth Park Capital Management, Royce & Associates, and Castine Capital Management were also bullish on Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK), allocating a large percentage of their portfolios to this stock.

Now, some big names have been driving this bullishness. EJF Capital, managed by Emanuel J. Friedman, initiated the largest position in Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK). EJF Capital had $1.7 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.7 million investment in the stock during the quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK) but similarly valued. We will take a look at Venator Materials PLC (NYSE:VNTR), CalAmp Corp. (NASDAQ:CAMP), UMH Properties, Inc (NYSE:UMH), and NII Holdings, Inc. (NASDAQ:NIHD). This group of stocks’ market caps are closest to OLBK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNTR | 16 | 74101 | -3 |

| CAMP | 15 | 32666 | -2 |

| UMH | 8 | 13751 | -1 |

| NIHD | 18 | 117146 | 1 |

| Average | 14.25 | 59416 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $59 million. That figure was $50 million in OLBK’s case. NII Holdings, Inc. (NASDAQ:NIHD) is the most popular stock in this table. On the other hand UMH Properties, Inc (NYSE:UMH) is the least popular one with only 8 bullish hedge fund positions. Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately OLBK wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); OLBK investors were disappointed as the stock returned -2.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.