Is NVIDIA Corporation (NASDAQ:NVDA) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

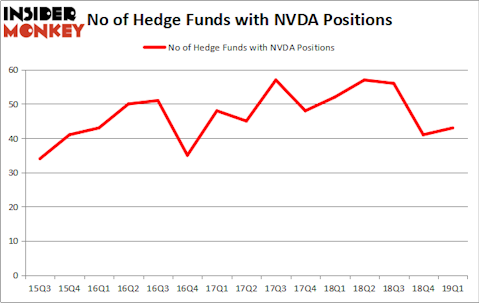

Is NVIDIA Corporation (NASDAQ:NVDA) the right pick for your portfolio? Investors who are in the know are in a bullish mood. The number of bullish hedge fund positions rose by 2 lately. Our calculations also showed that NVDA isn’t among the 30 most popular stocks among hedge funds. NVDA was in 43 hedge funds’ portfolios at the end of March. There were 41 hedge funds in our database with NVDA positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the new hedge fund action encompassing NVIDIA Corporation (NASDAQ:NVDA).

What have hedge funds been doing with NVIDIA Corporation (NASDAQ:NVDA)?

At Q1’s end, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. On the other hand, there were a total of 52 hedge funds with a bullish position in NVDA a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the most valuable position in NVIDIA Corporation (NASDAQ:NVDA). Citadel Investment Group has a $551.4 million call position in the stock, comprising 0.3% of its 13F portfolio. The second largest stake is held by Viking Global, managed by Andreas Halvorsen, which holds a $338.5 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of Philippe Laffont’s Coatue Management, David Blood and Al Gore’s Generation Investment Management and Ken Griffin’s Citadel Investment Group.

Consequently, specific money managers have been driving this bullishness. Viking Global, managed by Andreas Halvorsen, initiated the largest position in NVIDIA Corporation (NASDAQ:NVDA). Viking Global had $338.5 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $65 million investment in the stock during the quarter. The following funds were also among the new NVDA investors: Benjamin A. Smith’s Laurion Capital Management, Fang Zheng’s Keywise Capital Management, and John Osterweis’s Osterweis Capital Management.

Let’s go over hedge fund activity in other stocks similar to NVIDIA Corporation (NASDAQ:NVDA). We will take a look at Royal Bank of Canada (NYSE:RY), Altria Group Inc (NYSE:MO), Costco Wholesale Corporation (NASDAQ:COST), and HDFC Bank Limited (NYSE:HDB). This group of stocks’ market valuations resemble NVDA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RY | 17 | 552491 | 3 |

| MO | 36 | 823787 | -5 |

| COST | 44 | 3323751 | -4 |

| HDB | 24 | 961489 | -4 |

| Average | 30.25 | 1415380 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $1415 million. That figure was $1595 million in NVDA’s case. Costco Wholesale Corporation (NASDAQ:COST) is the most popular stock in this table. On the other hand Royal Bank of Canada (NYSE:RY) is the least popular one with only 17 bullish hedge fund positions. NVIDIA Corporation (NASDAQ:NVDA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately NVDA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NVDA were disappointed as the stock returned -22.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.