Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Northern Oil & Gas, Inc. (NYSE:NOG), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

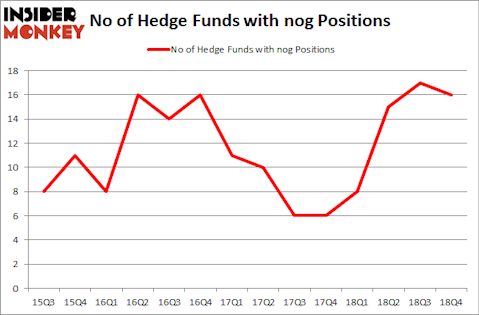

Is Northern Oil & Gas, Inc. (NYSE:NOG) a splendid investment now? Hedge funds are taking a pessimistic view. The number of bullish hedge fund bets retreated by 1 lately. Our calculations also showed that nog isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the latest hedge fund action regarding Northern Oil & Gas, Inc. (NYSE:NOG).

How have hedgies been trading Northern Oil & Gas, Inc. (NYSE:NOG)?

At the end of the fourth quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in NOG a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Northern Oil & Gas, Inc. (NYSE:NOG) was held by Citadel Investment Group, which reported holding $31.2 million worth of stock at the end of December. It was followed by Angelo Gordon & Co with a $25.3 million position. Other investors bullish on the company included Millennium Management, Meghalaya Partners, and Oaktree Capital Management.

Judging by the fact that Northern Oil & Gas, Inc. (NYSE:NOG) has experienced bearish sentiment from the smart money, it’s easy to see that there exists a select few fund managers that slashed their entire stakes heading into Q3. Interestingly, Bruce Kovner’s Caxton Associates LP said goodbye to the biggest stake of the 700 funds monitored by Insider Monkey, totaling an estimated $0.2 million in stock. Ben Levine, Andrew Manuel and Stefan Renold’s fund, LMR Partners, also sold off its stock, about $0.2 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Northern Oil & Gas, Inc. (NYSE:NOG). These stocks are Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA), Arbor Realty Trust, Inc. (NYSE:ABR), Rent-A-Center Inc (NASDAQ:RCII), and Enterprise Financial Services Corp (NASDAQ:EFSC). This group of stocks’ market values resemble NOG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MNTA | 20 | 195727 | 2 |

| ABR | 15 | 21089 | 5 |

| RCII | 19 | 249791 | 2 |

| EFSC | 15 | 53093 | 2 |

| Average | 17.25 | 129925 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $130 million. That figure was $103 million in NOG’s case. Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) is the most popular stock in this table. On the other hand Arbor Realty Trust, Inc. (NYSE:ABR) is the least popular one with only 15 bullish hedge fund positions. Northern Oil & Gas, Inc. (NYSE:NOG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on NOG, though not to the same extent, as the stock returned 20.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.