“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on New Jersey Resources Corp (NYSE:NJR) in order to identify whether reputable and successful top money managers continue to believe in its potential.

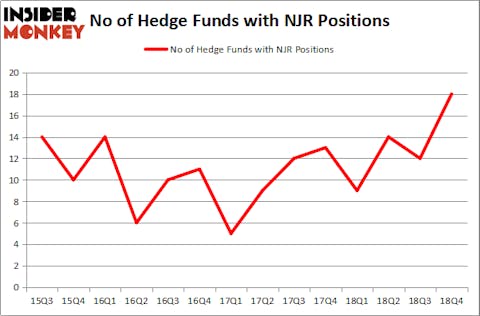

New Jersey Resources Corp (NYSE:NJR) was in 18 hedge funds’ portfolios at the end of the fourth quarter of 2018. NJR shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. There were 12 hedge funds in our database with NJR positions at the end of the previous quarter. Our calculations also showed that NJR isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most traders, hedge funds are seen as slow, old financial vehicles of the past. While there are more than 8000 funds with their doors open at the moment, Our researchers hone in on the masters of this club, about 750 funds. These hedge fund managers watch over most of the smart money’s total asset base, and by monitoring their inimitable stock picks, Insider Monkey has identified a few investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to view the recent hedge fund action surrounding New Jersey Resources Corp (NYSE:NJR).

Hedge fund activity in New Jersey Resources Corp (NYSE:NJR)

Heading into the first quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the previous quarter. By comparison, 9 hedge funds held shares or bullish call options in NJR a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in New Jersey Resources Corp (NYSE:NJR) was held by Renaissance Technologies, which reported holding $43.1 million worth of stock at the end of September. It was followed by GLG Partners with a $20.8 million position. Other investors bullish on the company included Millennium Management, AQR Capital Management, and Perella Weinberg Partners.

Consequently, key money managers have jumped into New Jersey Resources Corp (NYSE:NJR) headfirst. PDT Partners, managed by Peter Muller, assembled the most valuable position in New Jersey Resources Corp (NYSE:NJR). PDT Partners had $2.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $1.5 million position during the quarter. The other funds with new positions in the stock are James Dondero’s Highland Capital Management, Hoon Kim’s Quantinno Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as New Jersey Resources Corp (NYSE:NJR) but similarly valued. We will take a look at Assured Guaranty Ltd. (NYSE:AGO), Williams-Sonoma, Inc. (NYSE:WSM), CIT Group Inc. (NYSE:CIT), and Amneal Pharmaceuticals, Inc. (NYSE:AMRX). This group of stocks’ market valuations resemble NJR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AGO | 33 | 571123 | 0 |

| WSM | 17 | 284244 | -6 |

| CIT | 26 | 600235 | 1 |

| AMRX | 8 | 75987 | -3 |

| Average | 21 | 382897 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $383 million. That figure was $93 million in NJR’s case. Assured Guaranty Ltd. (NYSE:AGO) is the most popular stock in this table. On the other hand Amneal Pharmaceuticals, Inc. (NYSE:AMRX) is the least popular one with only 8 bullish hedge fund positions. New Jersey Resources Corp (NYSE:NJR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NJR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); NJR investors were disappointed as the stock returned 6.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.