Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost more than 25%. Facebook, which was the second most popular stock, lost 20% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the first 2.5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Hedge fund interest in The Navigators Group, Inc (NASDAQ:NAVG) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare NAVG to other stocks including Bottomline Technologies (NASDAQ:EPAY), Whiting Petroleum Corporation (NYSE:WLL), and Tenable Holdings, Inc. (NASDAQ:TENB) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a peek at the recent hedge fund action encompassing The Navigators Group, Inc (NASDAQ:NAVG).

How have hedgies been trading The Navigators Group, Inc (NASDAQ:NAVG)?

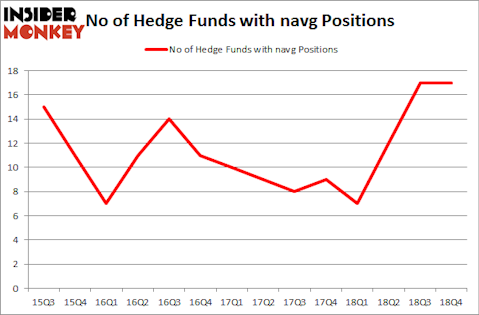

Heading into the first quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in NAVG a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Diamond Hill Capital, managed by Ric Dillon, holds the biggest position in The Navigators Group, Inc (NASDAQ:NAVG). Diamond Hill Capital has a $80.1 million position in the stock, comprising 0.5% of its 13F portfolio. Sitting at the No. 2 spot is Carlson Capital, led by Clint Carlson, holding a $50.4 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Remaining peers that are bullish comprise Jim Simons’s Renaissance Technologies, John Orrico’s Water Island Capital and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Due to the fact that The Navigators Group, Inc (NASDAQ:NAVG) has experienced declining sentiment from the entirety of the hedge funds we track, we can see that there exists a select few fund managers who sold off their full holdings heading into Q3. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the biggest stake of the 700 funds tracked by Insider Monkey, worth about $8 million in stock. Michael Hintze’s fund, CQS Cayman LP, also cut its stock, about $1.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The Navigators Group, Inc (NASDAQ:NAVG) but similarly valued. We will take a look at Bottomline Technologies (de), Inc. (NASDAQ:EPAY), Whiting Petroleum Corporation (NYSE:WLL), Tenable Holdings, Inc. (NASDAQ:TENB), and II-VI, Inc. (NASDAQ:IIVI). All of these stocks’ market caps are similar to NAVG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPAY | 17 | 74972 | -2 |

| WLL | 33 | 356034 | -6 |

| TENB | 15 | 49207 | -4 |

| IIVI | 22 | 139334 | 9 |

| Average | 21.75 | 154887 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $243 million in NAVG’s case. Whiting Petroleum Corporation (NYSE:WLL) is the most popular stock in this table. On the other hand Tenable Holdings, Inc. (NASDAQ:TENB) is the least popular one with only 15 bullish hedge fund positions. The Navigators Group, Inc (NASDAQ:NAVG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NAVG wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); NAVG investors were disappointed as the stock returned 0.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.