We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of MGM Resorts International (NYSE:MGM) based on that data.

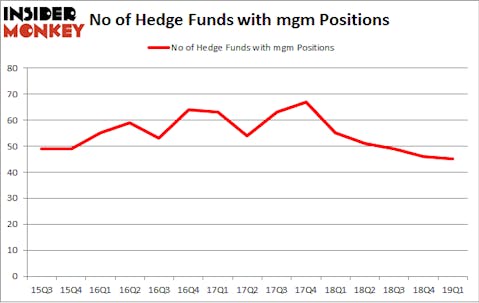

Is MGM Resorts International (NYSE:MGM) a buy here? Money managers are selling. The number of bullish hedge fund bets were trimmed by 1 in recent months. Our calculations also showed that mgm isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a large number of indicators stock market investors use to evaluate stocks. Two of the best indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top hedge fund managers can trounce the S&P 500 by a significant margin (see the details here).

Let’s take a peek at the new hedge fund action encompassing MGM Resorts International (NYSE:MGM).

How are hedge funds trading MGM Resorts International (NYSE:MGM)?

At Q1’s end, a total of 45 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MGM over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Corvex Capital held the most valuable stake in MGM Resorts International (NYSE:MGM), which was worth $402.7 million at the end of the first quarter. On the second spot was Canyon Capital Advisors which amassed $335.6 million worth of shares. Moreover, Two Sigma Advisors, Gates Capital Management, and Starboard Value LP were also bullish on MGM Resorts International (NYSE:MGM), allocating a large percentage of their portfolios to this stock.

Judging by the fact that MGM Resorts International (NYSE:MGM) has experienced declining sentiment from hedge fund managers, we can see that there lies a certain “tier” of hedgies that elected to cut their positions entirely last quarter. Intriguingly, Keith Meister’s Corvex Capital said goodbye to the largest investment of the 700 funds monitored by Insider Monkey, comprising an estimated $48.5 million in stock. Matthew Knauer and Mina Faltas’s fund, Nokota Management, also dumped its stock, about $27.8 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 1 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to MGM Resorts International (NYSE:MGM). We will take a look at International Flavors & Fragrances Inc (NYSE:IFF), Marathon Oil Corporation (NYSE:MRO), Rollins, Inc. (NYSE:ROL), and Dover Corporation (NYSE:DOV). All of these stocks’ market caps match MGM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IFF | 16 | 188308 | -5 |

| MRO | 37 | 732698 | 0 |

| ROL | 20 | 286732 | -2 |

| DOV | 30 | 474968 | 1 |

| Average | 25.75 | 420677 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $421 million. That figure was $1757 million in MGM’s case. Marathon Oil Corporation (NYSE:MRO) is the most popular stock in this table. On the other hand International Flavors & Fragrances Inc (NYSE:IFF) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks MGM Resorts International (NYSE:MGM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MGM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MGM were disappointed as the stock returned -1.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.