A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of Methode Electronics Inc. (NYSE:MEI) during the quarter.

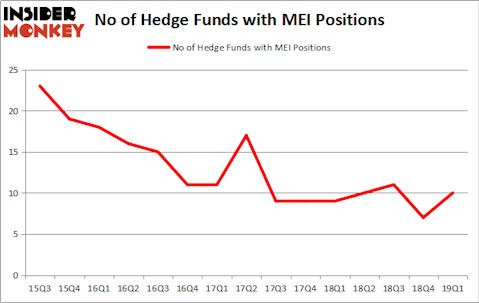

Methode Electronics Inc. (NYSE:MEI) was in 10 hedge funds’ portfolios at the end of the first quarter of 2019. MEI has seen an increase in support from the world’s most elite money managers lately. There were 7 hedge funds in our database with MEI positions at the end of the previous quarter. Our calculations also showed that MEI isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the recent hedge fund action surrounding Methode Electronics Inc. (NYSE:MEI).

What have hedge funds been doing with Methode Electronics Inc. (NYSE:MEI)?

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MEI over the last 15 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ariel Investments, managed by John W. Rogers, holds the biggest position in Methode Electronics Inc. (NYSE:MEI). Ariel Investments has a $28.4 million position in the stock, comprising 0.4% of its 13F portfolio. Coming in second is Chuck Royce of Royce & Associates, with a $24.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish include Jim Simons’s Renaissance Technologies, Ken Griffin’s Citadel Investment Group and Israel Englander’s Millennium Management.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Millennium Management, managed by Israel Englander, created the biggest position in Methode Electronics Inc. (NYSE:MEI). Millennium Management had $2.2 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $0.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, Mike Vranos’s Ellington, and Guy Shahar’s DSAM Partners.

Let’s go over hedge fund activity in other stocks similar to Methode Electronics Inc. (NYSE:MEI). These stocks are Domo Inc. (NASDAQ:DOMO), Funko, Inc. (NASDAQ:FNKO), Caleres Inc (NYSE:CAL), and Pacific Drilling SA (NYSE:PACD). This group of stocks’ market valuations match MEI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DOMO | 21 | 185107 | 8 |

| FNKO | 16 | 92590 | 3 |

| CAL | 10 | 48497 | -2 |

| PACD | 6 | 496640 | 0 |

| Average | 13.25 | 205709 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $206 million. That figure was $83 million in MEI’s case. Domo Inc. (NASDAQ:DOMO) is the most popular stock in this table. On the other hand Pacific Drilling SA (NYSE:PACD) is the least popular one with only 6 bullish hedge fund positions. Methode Electronics Inc. (NYSE:MEI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MEI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MEI investors were disappointed as the stock returned -6.8% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.