Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

McEwen Mining Inc (NYSE:MUX) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 5 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as MAG Silver Corporation (NYSE:MAG), Newpark Resources Inc (NYSE:NR), and Intra-Cellular Therapies Inc (NASDAQ:ITCI) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a peek at the new hedge fund action surrounding McEwen Mining Inc (NYSE:MUX).

What have hedge funds been doing with McEwen Mining Inc (NYSE:MUX)?

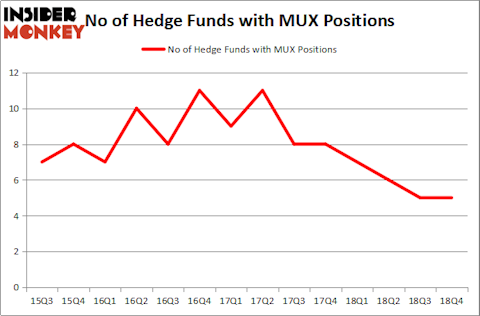

At Q4’s end, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MUX over the last 14 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Vertex One Asset Management was the largest shareholder of McEwen Mining Inc (NYSE:MUX), with a stake worth $2.8 million reported as of the end of December. Trailing Vertex One Asset Management was Citadel Investment Group, which amassed a stake valued at $2.6 million. D E Shaw, Horizon Asset Management, and PEAK6 Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Millennium Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was PEAK6 Capital Management).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as McEwen Mining Inc (NYSE:MUX) but similarly valued. These stocks are MAG Silver Corporation (NYSE:MAG), Newpark Resources Inc (NYSE:NR), Intra-Cellular Therapies Inc (NASDAQ:ITCI), and istar Inc (NYSE:STAR). All of these stocks’ market caps match MUX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAG | 14 | 34762 | 1 |

| NR | 10 | 31545 | -4 |

| ITCI | 15 | 57803 | -1 |

| STAR | 8 | 68468 | 0 |

| Average | 11.75 | 48145 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $6 million in MUX’s case. Intra-Cellular Therapies Inc (NASDAQ:ITCI) is the most popular stock in this table. On the other hand istar Inc (NYSE:STAR) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks McEwen Mining Inc (NYSE:MUX) is even less popular than STAR. Hedge funds dodged a bullet by taking a bearish stance towards MUX. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately MUX wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); MUX investors were disappointed as the stock returned -27.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.