Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like McDonald’s Corporation (NYSE:MCD).

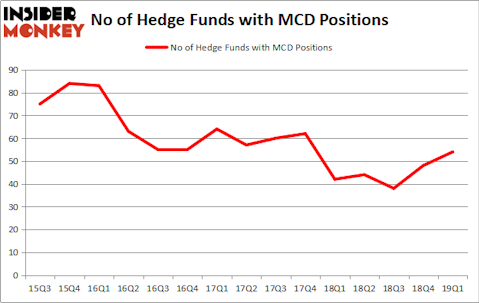

McDonald’s Corporation (NYSE:MCD) investors should be aware of an increase in support from the world’s most elite money managers lately. MCD was in 54 hedge funds’ portfolios at the end of March. There were 48 hedge funds in our database with MCD positions at the end of the previous quarter. Our calculations also showed that MCD isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a glance at the latest hedge fund action encompassing McDonald’s Corporation (NYSE:MCD).

How are hedge funds trading McDonald’s Corporation (NYSE:MCD)?

Heading into the second quarter of 2019, a total of 54 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. By comparison, 42 hedge funds held shares or bullish call options in MCD a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in McDonald’s Corporation (NYSE:MCD), which was worth $461.4 million at the end of the first quarter. On the second spot was Two Sigma Advisors which amassed $397.7 million worth of shares. Moreover, Marshall Wace LLP, D E Shaw, and Millennium Management were also bullish on McDonald’s Corporation (NYSE:MCD), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds were breaking ground themselves. Melvin Capital Management, managed by Gabriel Plotkin, established the most valuable position in McDonald’s Corporation (NYSE:MCD). Melvin Capital Management had $85.5 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also initiated a $65.8 million position during the quarter. The other funds with new positions in the stock are Aaron Cowen’s Suvretta Capital Management, Robert Pohly’s Samlyn Capital, and Leon Shaulov’s Maplelane Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as McDonald’s Corporation (NYSE:MCD) but similarly valued. These stocks are TOTAL S.A. (NYSE:TOT), Abbott Laboratories (NYSE:ABT), BHP Group (NYSE:BHP), and SAP SE (NYSE:SAP). All of these stocks’ market caps resemble MCD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TOT | 13 | 971886 | 4 |

| ABT | 50 | 1859812 | -1 |

| BHP | 15 | 637521 | 0 |

| SAP | 8 | 1173668 | -6 |

| Average | 21.5 | 1160722 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $1161 million. That figure was $3121 million in MCD’s case. Abbott Laboratories (NYSE:ABT) is the most popular stock in this table. On the other hand SAP SE (NYSE:SAP) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks McDonald’s Corporation (NYSE:MCD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on MCD as the stock returned 4.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.