World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

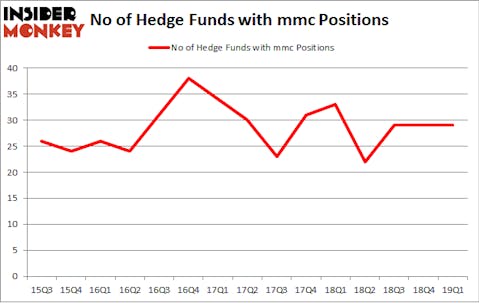

Marsh & McLennan Companies, Inc. (NYSE:MMC) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 29 hedge funds’ portfolios at the end of March. At the end of this article we will also compare MMC to other stocks including FedEx Corporation (NYSE:FDX), Las Vegas Sands Corp. (NYSE:LVS), and ING Groep N.V. (NYSE:ING) to get a better sense of its popularity.

In the eyes of most shareholders, hedge funds are seen as underperforming, old investment vehicles of years past. While there are over 8000 funds in operation at the moment, Our researchers look at the leaders of this club, approximately 750 funds. It is estimated that this group of investors direct most of the smart money’s total capital, and by tailing their first-class equity investments, Insider Monkey has revealed several investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to go over the new hedge fund action encompassing Marsh & McLennan Companies, Inc. (NYSE:MMC).

What does the smart money think about Marsh & McLennan Companies, Inc. (NYSE:MMC)?

At the end of the first quarter, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MMC over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Marsh & McLennan Companies, Inc. (NYSE:MMC), which was worth $201.1 million at the end of the first quarter. On the second spot was Diamond Hill Capital which amassed $166.3 million worth of shares. Moreover, Polar Capital, Adage Capital Management, and Markel Gayner Asset Management were also bullish on Marsh & McLennan Companies, Inc. (NYSE:MMC), allocating a large percentage of their portfolios to this stock.

Because Marsh & McLennan Companies, Inc. (NYSE:MMC) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there is a sect of funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Anand Parekh’s Alyeska Investment Group dumped the biggest position of the “upper crust” of funds watched by Insider Monkey, worth an estimated $32.3 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dumped its stock, about $12.1 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Marsh & McLennan Companies, Inc. (NYSE:MMC). These stocks are FedEx Corporation (NYSE:FDX), Las Vegas Sands Corp. (NYSE:LVS), ING Groep N.V. (NYSE:ING), and America Movil SAB de CV (NYSE:AMX). This group of stocks’ market values are similar to MMC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FDX | 41 | 2267038 | 0 |

| LVS | 37 | 1709179 | -7 |

| ING | 10 | 491851 | 3 |

| AMX | 14 | 234341 | 2 |

| Average | 25.5 | 1175602 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $1176 million. That figure was $806 million in MMC’s case. FedEx Corporation (NYSE:FDX) is the most popular stock in this table. On the other hand ING Groep N.V. (NYSE:ING) is the least popular one with only 10 bullish hedge fund positions. Marsh & McLennan Companies, Inc. (NYSE:MMC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on MMC as the stock returned 2.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.