Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves.

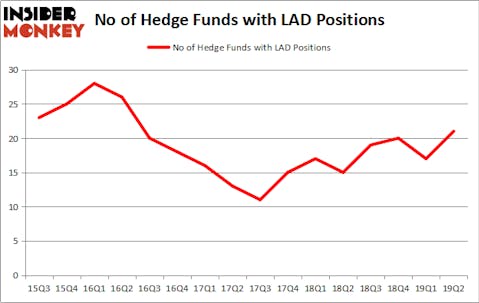

Lithia Motors Inc (NYSE:LAD) was in 21 hedge funds’ portfolios at the end of June. LAD has experienced an increase in enthusiasm from smart money of late. There were 17 hedge funds in our database with LAD positions at the end of the previous quarter. Our calculations also showed that LAD isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the key hedge fund action encompassing Lithia Motors Inc (NYSE:LAD).

Hedge fund activity in Lithia Motors Inc (NYSE:LAD)

Heading into the third quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 24% from the previous quarter. On the other hand, there were a total of 15 hedge funds with a bullish position in LAD a year ago. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Abrams Capital Management was the largest shareholder of Lithia Motors Inc (NYSE:LAD), with a stake worth $273.2 million reported as of the end of March. Trailing Abrams Capital Management was Cardinal Capital, which amassed a stake valued at $91.7 million. Park West Asset Management, GLG Partners, and Lakewood Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key hedge funds were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most outsized position in Lithia Motors Inc (NYSE:LAD). Arrowstreet Capital had $17.3 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also initiated a $5.1 million position during the quarter. The other funds with brand new LAD positions are Richard Driehaus’s Driehaus Capital, Peter Muller’s PDT Partners, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Lithia Motors Inc (NYSE:LAD) but similarly valued. We will take a look at Brooks Automation, Inc. (NASDAQ:BRKS), Valmont Industries, Inc. (NYSE:VMI), GATX Corporation (NYSE:GATX), and Dana Incorporated (NYSE:DAN). All of these stocks’ market caps are closest to LAD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRKS | 13 | 108740 | 4 |

| VMI | 25 | 294997 | 6 |

| GATX | 13 | 224982 | 2 |

| DAN | 25 | 363492 | -2 |

| Average | 19 | 248053 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $248 million. That figure was $551 million in LAD’s case. Valmont Industries, Inc. (NYSE:VMI) is the most popular stock in this table. On the other hand Brooks Automation, Inc. (NASDAQ:BRKS) is the least popular one with only 13 bullish hedge fund positions. Lithia Motors Inc (NYSE:LAD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on LAD as the stock returned 11.7% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.