Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by more than 6 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Kindred Biosciences Inc (NASDAQ:KIN) from the perspective of those elite funds.

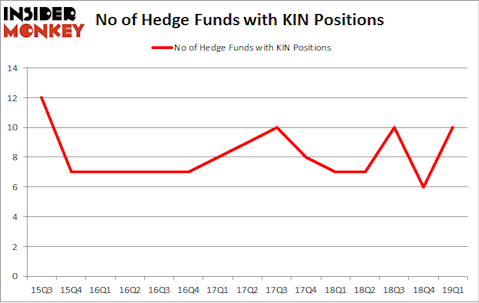

Is Kindred Biosciences Inc (NASDAQ:KIN) an attractive stock to buy now? Hedge funds are in an optimistic mood. The number of long hedge fund bets improved by 4 lately. Our calculations also showed that kin isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of formulas investors can use to appraise publicly traded companies. A duo of the less utilized formulas are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the top fund managers can beat their index-focused peers by a significant margin (see the details here).

Let’s take a look at the recent hedge fund action encompassing Kindred Biosciences Inc (NASDAQ:KIN).

How are hedge funds trading Kindred Biosciences Inc (NASDAQ:KIN)?

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 67% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards KIN over the last 15 quarters. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Park West Asset Management, managed by Peter S. Park, holds the biggest position in Kindred Biosciences Inc (NASDAQ:KIN). Park West Asset Management has a $61.8 million position in the stock, comprising 2.7% of its 13F portfolio. On Park West Asset Management’s heels is John W. Rogers of Ariel Investments, with a $24 million position; 0.3% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors with similar optimism comprise Phill Gross and Robert Atchinson’s Adage Capital Management, Jim Simons’s Renaissance Technologies and Anand Parekh’s Alyeska Investment Group.

As aggregate interest increased, specific money managers were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, created the most valuable position in Kindred Biosciences Inc (NASDAQ:KIN). Alyeska Investment Group had $3.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $2.5 million position during the quarter. The following funds were also among the new KIN investors: David Rosen’s Rubric Capital Management, Frank Slattery’s Symmetry Peak Management, and David Harding’s Winton Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Kindred Biosciences Inc (NASDAQ:KIN) but similarly valued. These stocks are Unifi, Inc. (NYSE:UFI), Fiesta Restaurant Group Inc (NASDAQ:FRGI), Motorcar Parts of America, Inc. (NASDAQ:MPAA), and NI Holdings, Inc. (NASDAQ:NODK). This group of stocks’ market caps resemble KIN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UFI | 11 | 69368 | 1 |

| FRGI | 18 | 94240 | -2 |

| MPAA | 9 | 93844 | -1 |

| NODK | 6 | 24094 | -1 |

| Average | 11 | 70387 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $120 million in KIN’s case. Fiesta Restaurant Group Inc (NASDAQ:FRGI) is the most popular stock in this table. On the other hand NI Holdings, Inc. (NASDAQ:NODK) is the least popular one with only 6 bullish hedge fund positions. Kindred Biosciences Inc (NASDAQ:KIN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately KIN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); KIN investors were disappointed as the stock returned -9.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.