The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Inter Parfums, Inc. (NASDAQ:IPAR).

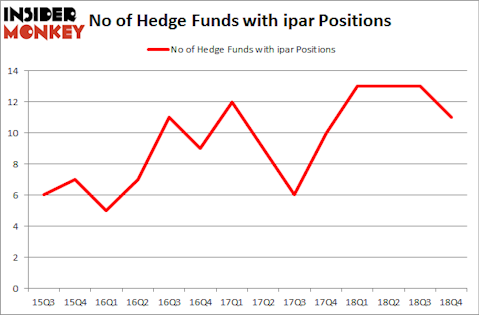

Inter Parfums, Inc. (NASDAQ:IPAR) has experienced a decrease in hedge fund interest of late. Our calculations also showed that ipar isn’t among the 30 most popular stocks among hedge funds.

Today there are dozens of gauges stock traders have at their disposal to size up stocks. Some of the best gauges are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can beat the broader indices by a significant margin (see the details here).

Let’s go over the latest hedge fund action regarding Inter Parfums, Inc. (NASDAQ:IPAR).

How are hedge funds trading Inter Parfums, Inc. (NASDAQ:IPAR)?

At Q4’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in IPAR a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Chuck Royce’s Royce & Associates has the biggest position in Inter Parfums, Inc. (NASDAQ:IPAR), worth close to $26.9 million, comprising 0.2% of its total 13F portfolio. Coming in second is Columbus Circle Investors, led by Principal Global Investors, holding a $17.5 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Other professional money managers that are bullish comprise Murray Stahl’s Horizon Asset Management, Jim Simons’s Renaissance Technologies and Cliff Asness’s AQR Capital Management.

Judging by the fact that Inter Parfums, Inc. (NASDAQ:IPAR) has witnessed a decline in interest from the smart money, it’s safe to say that there were a few hedge funds that decided to sell off their full holdings heading into Q3. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the biggest stake of the “upper crust” of funds tracked by Insider Monkey, comprising close to $0.9 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $0.4 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Inter Parfums, Inc. (NASDAQ:IPAR) but similarly valued. We will take a look at Veoneer, Inc. (NYSE:VNE), SendGrid, Inc. (NYSE:SEND), Iridium Communications Inc. (NASDAQ:IRDM), and Cactus, Inc. (NYSE:WHD). This group of stocks’ market caps are closest to IPAR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNE | 10 | 183076 | 0 |

| SEND | 26 | 366686 | 6 |

| IRDM | 13 | 112828 | 2 |

| WHD | 18 | 160146 | 1 |

| Average | 16.75 | 205684 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $206 million. That figure was $71 million in IPAR’s case. SendGrid, Inc. (NYSE:SEND) is the most popular stock in this table. On the other hand Veoneer, Inc. (NYSE:VNE) is the least popular one with only 10 bullish hedge fund positions. Inter Parfums, Inc. (NASDAQ:IPAR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately IPAR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); IPAR investors were disappointed as the stock returned 12.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.