Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Herc Holdings Inc. (NYSE:HRI).

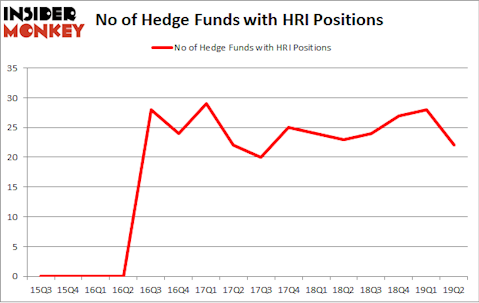

Herc Holdings Inc. (NYSE:HRI) was in 22 hedge funds’ portfolios at the end of June. HRI investors should pay attention to a decrease in hedge fund interest recently. There were 28 hedge funds in our database with HRI positions at the end of the previous quarter. Our calculations also showed that HRI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the new hedge fund action encompassing Herc Holdings Inc. (NYSE:HRI).

How are hedge funds trading Herc Holdings Inc. (NYSE:HRI)?

Heading into the third quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from the previous quarter. By comparison, 23 hedge funds held shares or bullish call options in HRI a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Icahn Capital LP, managed by Carl Icahn, holds the largest position in Herc Holdings Inc. (NYSE:HRI). Icahn Capital LP has a $206 million position in the stock, comprising 0.8% of its 13F portfolio. On Icahn Capital LP’s heels is Mario Gabelli of GAMCO Investors, with a $176.2 million position; 1.3% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish comprise Jared Nussbaum’s Nut Tree Capital, Chuck Royce’s Royce & Associates and Jonathan Kolatch’s Redwood Capital Management.

Due to the fact that Herc Holdings Inc. (NYSE:HRI) has experienced a decline in interest from the entirety of the hedge funds we track, logic holds that there exists a select few hedge funds that elected to cut their positions entirely by the end of the second quarter. It’s worth mentioning that Isaac Corre’s Governors Lane sold off the largest position of the “upper crust” of funds watched by Insider Monkey, totaling an estimated $8.8 million in stock, and David Keidan’s Buckingham Capital Management was right behind this move, as the fund said goodbye to about $3.9 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 6 funds by the end of the second quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Herc Holdings Inc. (NYSE:HRI). We will take a look at Nexa Resources S.A. (NYSE:NEXA), OceanFirst Financial Corp. (NASDAQ:OCFC), PRA Group, Inc. (NASDAQ:PRAA), and Frank’s International NV (NYSE:FI). This group of stocks’ market caps match HRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEXA | 9 | 10148 | -2 |

| OCFC | 13 | 64180 | 0 |

| PRAA | 8 | 27127 | -3 |

| FI | 15 | 26617 | 3 |

| Average | 11.25 | 32018 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $550 million in HRI’s case. Frank’s International NV (NYSE:FI) is the most popular stock in this table. On the other hand PRA Group, Inc. (NASDAQ:PRAA) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Herc Holdings Inc. (NYSE:HRI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately HRI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HRI were disappointed as the stock returned 1.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.